WeightWatchers 2005 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2005 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.In NACO, meeting fees for fiscal 2005 were $417.0 million, up 11.8% from $373.1 million in the

prior year. NACO meeting fee growth was primarily driven by a price increase in approximately 40% of

NACO for the full year of fiscal 2005, and an additional approximately 20% of NACO beginning in

September 2005; and by a 3.5% increase in NACO attendance over the comparable prior year period.

International company-owned meeting fees were $264.2 million for fiscal 2005, an increase of

$8.2 million, or 3.2%, from $256.0 million for fiscal 2004. International meeting fee growth was

primarily driven by attendance and meeting fee per attendee growth in Continental Europe, and by a

price increase in the United Kingdom. On a local currency basis, international meeting fee revenues

grew 3.5%. Meeting fee growth in the United Kingdom was negatively impacted due to lower

attendances of 3.1%, decreasing from 13.0 million in fiscal 2004 to 12.6 million in fiscal 2005.

Worldwide product sales for fiscal 2005 were $285.4 million, an increase of $10.8 million, or 3.9%,

from $274.6 million for fiscal 2004. Domestically, product sales rose $6.0 million, or 4.3%, to

$144.4 million in fiscal 2005, despite the stronger growth in sales that occurred in the third quarter of

fiscal 2004 related to the launch of the TurnAround innovation in NACO as is typical with a new

innovation. Domestic product sales grew 9.7% in the first half of fiscal 2005 and 13.5% in the fourth

quarter of fiscal 2005 primarily as a result of refreshing our in-meeting consumables and adding new

offerings which have been well received. Internationally, product sales increased 3.5%, or $4.8 million,

to $141.1 million, also on the strength of new product introductions.

Online revenues were $109.7 million for fiscal 2005 as compared to $65.0 million in fiscal 2004

which included only nine months of WeightWatchers.com results due to the timing of our adoption of

FIN 46R. Growth in online revenues from the second to the fourth quarter of fiscal 2005 period versus

the comparable nine months of 2004 was $18.4 million, or 20.2%, due to an 18.6% increase in active

end-of-period subscribers and a price increase in July 2004. Our first quarter of fiscal 2005 consolidated

results included $26.3 million of online revenues.

Other revenue, comprised primarily of licensing revenues and our publications, was $55.7 million

for fiscal 2005, an increase of $18.3 million, or 48.9%, from $37.4 million for fiscal 2004. Licensing

revenues increased $21.5 million, or 129.5%, due to the continued growth of our licensees around the

world, the addition of new licensees and the full year benefit from the third party license royalties

which reverted to us from Heinz at the end of September 2004. On a comparable basis, excluding the

impact of the reversion, licensing revenues increased 87.7%. Additionally, as mentioned above, our

fiscal 2004 consolidated results included $2.0 million of WeightWatchers.com royalty income, due to the

timing of the adoption of FIN 46R.

Franchise royalties were $12.5 million domestically and $6.9 million internationally for fiscal 2005.

Total franchise royalties were $19.4 million, up from $18.8 million in the prior year. Excluding the

franchises acquired in fiscal 2004, domestic franchise royalties increased 8.1%, while international

franchise royalties rose 8.6%.

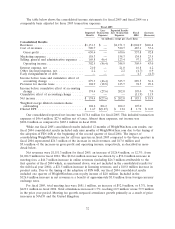

Cost of revenues was $520.7 million for fiscal 2005, an increase of $33.6 million, or 6.9%, from

$487.1 million for fiscal 2004. Gross profit margin of 54.8% of sales in fiscal 2005 increased 230 basis

points from 52.5% of sales in the prior year. A number of factors contributed to this margin expansion:

price increases in NACO and U.K. meeting fees and in the WeightWatchers.com subscription fee; less

frequent discounting of product sales; and strong growth in our high margin licensing business. Further,

WeightWatchers.com’s margin has increased as it has leveraged its existing infrastructure while growing

its business.

Marketing expenses increased $23.5 million, or 17.4%, to $158.3 million for fiscal 2005 from

$134.8 million for fiscal 2004. The inclusion of WeightWatchers.com in the first quarter of fiscal 2005,

typically when our highest marketing spend occurs, contributed nearly one third of the increase—

$8.3 million versus the prior year. The remainder of the increase in marketing spend is largely driven by

timing. In fiscal 2005, we resumed in Continental Europe and the United Kingdom our practice of

launching, and therefore expensing, our January winter diet season direct marketing campaign in late

33