WeightWatchers 2005 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2005 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

9. Stock Plans

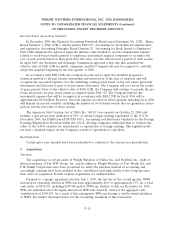

WWI Incentive Compensation Plans:

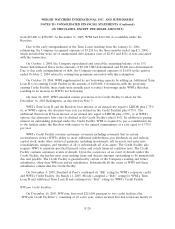

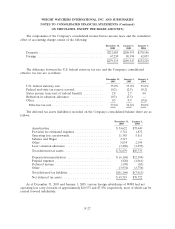

On May 12, 2004 and December 16, 1999, respectively, the WWI stockholders approved the 2004

Stock Incentive Plan (the ‘‘2004 Plan’’) and the 1999 Stock Purchase and Option Plan (the ‘‘1999

Plan’’) of WWI. These plans are designed to promote the long-term financial interests and growth of

WWI by attracting and retaining management with the ability to contribute to the success of the

business. The Board of Directors or a committee thereof administers the plans.

Under the 2004 Plan, grants may take the following forms at the committee’s sole discretion:

incentive stock options, stock appreciation rights, restricted stock units and other stock-based awards.

The maximum number of shares available for grant under the 2004 Plan is 2,500 as of the plan’s

effective date.

Under the 1999 Plan, grants may take the following forms at the committee’s sole discretion:

incentive stock options, other stock options (other than incentive options), stock appreciation rights,

restricted stock, purchase stock, dividend equivalent rights, performance units, performance shares and

other stock—based grants. The maximum number of shares available for grant under this plan was

5,647 shares of authorized common stock as of the plan’s effective date. In 2001, the number of shares

available for grant was increased to 7,058 shares.

Under the stock purchase component of the 1999 Plan, 1,639 shares of common stock were sold to

45 members of WWI’s management group at a price of $2.13 to $4.04 per share.

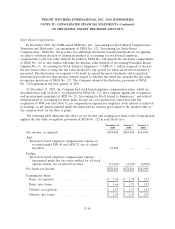

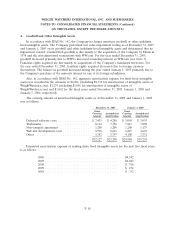

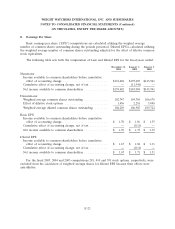

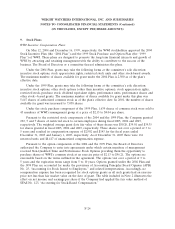

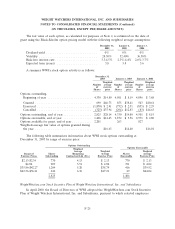

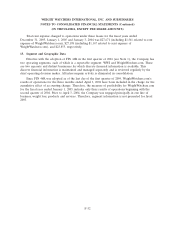

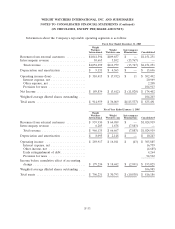

Pursuant to the restricted stock components of the 2004 and the 1999 Plan, the Company granted

222, 5 and 7 shares of restricted stock to certain employees during fiscal 2005, 2004 and 2003,

respectively. The weighted average grant date fair value of these shares was $50.26, $39.01 and $39.35

for shares granted in fiscal 2005, 2004 and 2003, respectively. These shares vest over a period of 3 to

5 years and resulted in compensation expense of $2,902 and $143 for the fiscal years ended

December 31, 2005 and January 1, 2005, respectively. As of December 31, 2005 there were 181

unvested units and $8,417 of unamortized compensation expense.

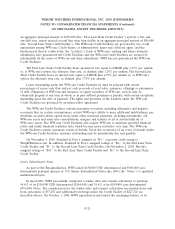

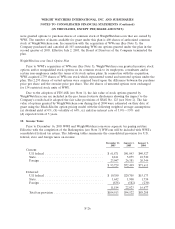

Pursuant to the option components of the 2004 and the 1999 Plan, the Board of Directors

authorized the Company to enter into agreements under which certain members of management

received Non-Qualified Time and Performance Stock Options providing them the opportunity to

purchase shares of WWI’s common stock at an exercise price of $2.13 to $56.21. The options are

exercisable based on the terms outlined in the agreement. The options vest over a period of 3 to

5 years and the expiration terms range from 5 to 10 years. Options granted under the 2004 Plan and

the 1999 Plan are accounted for under the provisions of Accounting Principles Board Opinion (APB)

No. 25, ‘‘Accounting for Stock Issued to Employees,’’ and related interpretations. Accordingly, no

compensation expense has been recognized for stock options grants as all such grants had an exercise

price not less than fair market value on the date of grant. The table included in Note 2 illustrates the

effect on net income and earnings per share if the Company had applied the fair value method of

SFAS No. 123, ‘‘Accounting for Stock-Based Compensation.’’

F-24