WeightWatchers 2005 Annual Report Download - page 88

Download and view the complete annual report

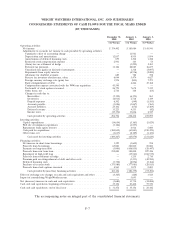

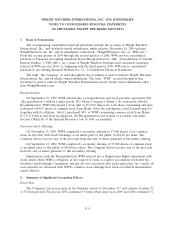

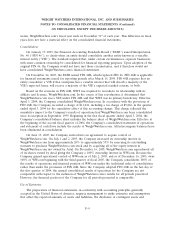

Please find page 88 of the 2005 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

Advertising Costs:

Advertising costs consist primarily of national and local direct mail, television, and spokesperson’s

fees. All costs related to advertising are expensed in the period incurred, except for TV and radio

media related costs that are expensed the first time the advertising takes place. Total advertising

expenses for the fiscal years ended December 31, 2005, January 1, 2005 and January 3, 2004 were

$151,533 (including $22,478 of WeightWatchers.com advertising costs), $128,116 (including $13,723 of

WeightWatchers.com advertising costs) and $107,931, respectively.

Income Taxes:

The Company accounts for income taxes in accordance with SFAS No. 109, ‘‘Accounting for

Income Taxes.’’ Under SFAS No. 109, deferred income tax assets and liabilities result primarily from

temporary differences between the financial statement and tax bases of assets and liabilities, using

enacted tax rates in effect for the year in which differences are expected to reverse. If it is more likely

than not that some portion of a deferred tax asset will not be realized, a valuation allowance is

recognized. We consider historic levels of income, estimates of future taxable income and feasible tax

planning strategies in assessing the need for a tax valuation allowance. We also establish an appropriate

level of additional provisions for income taxes in the event that certain positions, which we believe are

fully supportable, are challenged by the tax authorities. We adjust these additional provisions in light of

changing facts and circumstances. If our filing positions are ultimately upheld under audits by

respective taxing authorities, the provision for income taxes in future years will reflect favorable

adjustments. In addition, under SFAS No. 109 assets and liabilities acquired in purchase business

combinations are assigned their fair values and deferred taxes are provided for lower or higher tax

bases.

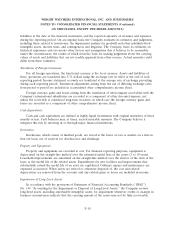

Derivative Instruments and Hedging:

Prior to the extinguishment of the euro denominated notes in 2004 (as described in Note 6), the

Company entered into forward and swap contracts to hedge transactions denominated in foreign

currencies in order to reduce the currency risk associated with fluctuating exchange rates. These

contracts were used primarily to hedge payments arising from those foreign currency denominated

obligations. The Company currently enters into interest rate swaps to hedge a substantial portion of its

variable rate debt. These contracts are used primarily to reduce the risk associated with variable

interest rate debt obligations.

In accordance with the provisions of SFAS No. 133, ‘‘Accounting for Derivative Instruments and

Hedging Activities,’’ and its related amendments, SFAS No. 138, ‘‘Accounting for Certain Derivative

Instruments and Certain Hedging Activities’’ and SFAS No. 149, ‘‘Amendment of Statement on

Derivative Instruments and Hedging Activities,’’ all derivative financial instruments are recorded on the

consolidated balance sheets at their fair value as either assets or liabilities. Changes in the fair value of

derivatives are recorded each period in earnings or accumulated other comprehensive income (loss),

depending on whether a derivative is designated and effective as part of a hedge transaction and, if it

is, the type of hedge transaction. Gains and losses on derivative instruments reported in accumulated

other comprehensive income (loss) are included in earnings in the periods in which earnings are

affected by the hedged item. The receivable or payable associated with derivative contracts is included

in the balance of prepaid expenses or accounts payable, respectively.

F-12