WeightWatchers 2005 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2005 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

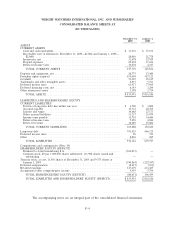

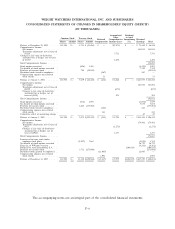

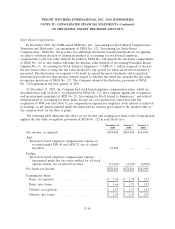

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS FOR THE FISCAL YEARS ENDED

(IN THOUSANDS)

December 31, January 1, January 3,

2005 2005 2004

(52 Weeks) (52 Weeks) (53 Weeks)

Operating activities:

Net income .......................................... $174,402 $ 183,084 $ 143,941

Adjustments to reconcile net income to cash provided by operating activities:

Cumulative effect of accounting change ....................... — 11,941 —

Depreciation and amortization ............................. 12,817 8,935 5,894

Amortization of deferred financing costs ....................... 879 1,308 1,248

Restricted stock compensation expense ........................ 2,901 143 53

(Gain) loss on settlement of hedge .......................... — (1,255) 5,381

Deferred tax provision .................................. 11,184 22,023 16,677

Unrealized loss (gain) on derivative instruments .................. — 1,318 (5,097)

Repayments from equity investee ........................... — (4,916) (5,000)

Allowance for doubtful accounts ............................ 629 728 552

Reserve for inventory obsolescence, other ...................... 6,044 5,474 4,627

Foreign currency exchange rate (gain) loss ..................... 1,576 (803) 7,271

Early extinguishment of debt .............................. — 4,264 47,368

Compensation expense associated with the WW.com acquisition ........ 43,590 — —

Tax benefit of stock options exercised ......................... 26,770 7,678 7,319

Other items, net ...................................... 2,714 144 (63)

Changes in cash due to:

Receivables ........................................ (9,125) (6,193) 861

Inventories ........................................ (6,014) 2,718 1,149

Prepaid expenses .................................... 6,302 (549) (1,555)

Accounts payable .................................... (1,026) (1,067) (563)

Accrued liabilities .................................... 25,102 (676) (3,469)

Deferred revenue .................................... 13,225 4,533 (42)

Income taxes ....................................... (15,174) 13,606 6,547

Cash provided by operating activities ....................... 296,796 252,438 233,099

Investing activities:

Capital expenditures ..................................... (14,634) (5,163) (5,029)

Web site development expeditures ............................ (3,184) (1,557) —

Repayments from equity investee ............................. — 4,916 5,000

Cash paid for acquisitions ................................. (380,832) (61,881) (210,470)

Other items, net ....................................... (1,617) (2,189) (1,121)

Cash used for investing activities .......................... (400,267) (65,874) (211,620)

Financing activities:

Net increase in short-term borrowings .......................... 1,329 (1,609) 998

Proceeds from borrowings ................................. 65,000 321,000 85,000

Payments on long-term debt ................................ (3,000) (456,055) (58,447)

Proceeds from new term loan ............................... 215,000 150,000 227,326

Repayment of high-yield loan ............................... — (15,541) (244,919)

Proceeds from settlement of hedge ............................ — 1,255 2,710

Premium paid on extinguishment of debt and other costs .............. — (1,331) (42,980)

Deferred financing costs .................................. (3,758) (2,896) (2,366)

Purchase of treasury stock ................................. (175,980) (177,081) (28,815)

Proceeds from stock options exercised .......................... 4,563 1,879 2,003

Cash provided by/(used for) financing activities ................. 103,154 (180,379) (59,490)

Effect of exchange rate changes on cash and cash equivalents and other ..... (3,365) (164) 3,923

Impact of consolidating WeightWatchers.com ....................... — 5,693 —

Net (decrease) increase in cash and cash equivalents .................. (3,680) 11,714 (34,088)

Cash and cash equivalents, beginning of fiscal year ................... 35,156 23,442 57,530

Cash and cash equivalents, end of fiscal year ....................... $ 31,476 $ 35,156 $ 23,442

The accompanying notes an integral part of the consolidated financial statements.

F-7