WeightWatchers 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Loans outstanding under the WW.com Credit Facilities (i) must be prepaid with certain

percentages of excess cash flow and net cash proceeds of asset sales, issuances, offerings or placements

of debt obligations of WeightWatchers.com and issuances of equity securities of WeightWatchers.com;

and (ii) may be voluntarily prepaid at any time in whole or in part without premium or penalty, with

certain exceptions depending on the date of payment. The WW.com First Lien Term Loan is also

subject to scheduled amortization of $425,000 per quarter.

The WW.com Credit Facilities contain customary covenants, including affirmative and negative

covenants that, in certain circumstances, restrict WeightWatchers.com’s ability to incur additional

indebtedness, pay dividends on and redeem capital stock, make other restricted payments, including

investments, sell WeightWatchers.com assets and enter into consolidations, mergers and transfer of all

or substantially all of WeightWatchers.com’s assets. The WW.com Credit Facilities also require

WeightWatchers.com to maintain specified financial ratios and satisfy financial condition tests, which

become more restrictive over time. The WW.com Credit Facilities contain customary events of default.

Upon the occurrence of an event of default under the WW.com Credit Facilities, amounts outstanding

may be immediately due and payable.

On November 4, 2005, Standard & Poor’s confirmed its ‘‘BB’’ rating for our corporate credit and

the WWI Credit Facility. On March 11, 2005, Moody’s assigned a ‘‘Ba1’’ rating for the WWI Term

Loan B and the WWI Additional Term Loan B and confirmed its ‘‘Ba1’’ rating for the WWI Credit

Facility.

On November 4, 2005, Standard & Poor’s assigned its ‘‘B+’’ corporate credit rating to

WeightWatchers.com. In addition, Standard & Poor’s assigned ratings of ‘‘B+’’ to the WW.com First

Lien Term Loan and ‘‘B-’’ to the WW.com Second Lien Term Loan. On November 2, 2005, Moody’s

assigned ratings of ‘‘Ba3’’ to the WW.com First Lien Term Loan and ‘‘B1’’ to the WW.com Second Lien

Term Loan.

Dividends

On February 16, 2006, our Board of Directors authorized the initiation of a quarterly cash

dividend of $0.175 per share of our common stock, which corresponds to an annual dividend rate of

$0.70 per share. The initial quarterly dividend will be payable on April 7, 2006 to shareholders of

record at the close of business on March 24, 2006.

The WWI Credit Facility provides that we are permitted to pay dividends in an aggregate amount

equal to $20.0 million plus 66.67% of our net income (as defined in the credit agreement) since

December 2, 2001, so long as we are not in default under our credit agreement and so long as we have

borrowing availability under the Revolver of at least $30.0 million. We do not expect these restrictions

to impair our ability to pay dividends, but they could do so.

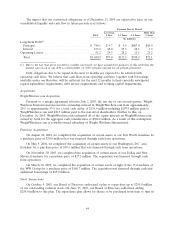

Contractual Obligations

We are obligated under non-cancelable operating leases primarily for office and rent facilities.

Consolidated rent expense charged to operations under all our leases for fiscal 2005 was approximately

$27.7 million.

43