WeightWatchers 2003 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2003 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

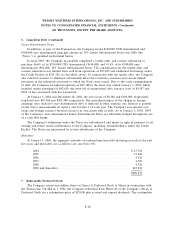

13. Employee Benefit Plans (Continued)

For certain senior management personnel, the Company sponsors the Weight Watchers Executive

Profit Sharing Plan. Under the Internal Revenue Service (‘‘IRS’’) definition, this plan is considered a

Nonqualified Deferred Compensation Plan. There is a promise of payment by the Company made on

the employees’ behalf instead of an individual account with a cash balance. The account is valued at

the end of each fiscal month, based on an annualized interest rate of prime plus 2%, with an

annualized cap of 15%. Expense related to these contributions for the fiscal years ended January 3,

2004, December 28, 2002 and December 29, 2001 was $774, $567, and $692, respectively.

During fiscal 2002, the Company received a favorable determination letter from the IRS that

qualifies the Company’s Savings Plan under Section 401(a) of the IRS Code.

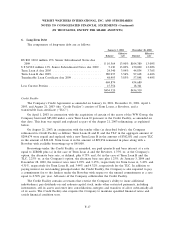

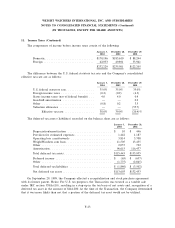

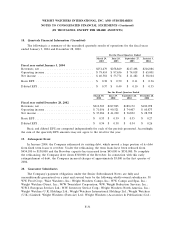

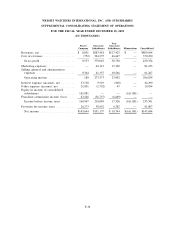

14. Cash Flow Information

January 3, December 28, December 29,

2004 2002 2001

Net cash paid during the year for:

Interest expense .................................... $38,533 $41,588 $54,556

Income taxes ...................................... $59,739 $75,684 $39,474

Noncash investing and financing activities were as follows:

Fair value of net assets acquired in connection with the

acquisitions ...................................... $4,797 $ 461 $ 3,709

Liabilities incurred in connection with the public equity offering . — — $ 1,950

Liability incurred in connection with a noncompete agreement . . — — $ 1,200

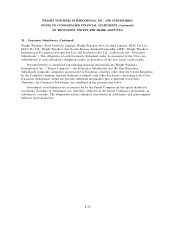

15. Commitments and Contingencies

Legal:

Due to the nature of its activities, the Company is, at times, subject to pending and threatened

legal actions that arise during the normal course of business. In the opinion of management, based in

part upon advice of legal counsel, the disposition of such matters is not expected to have a material

effect on the Company’s results of operations, financial condition or cash flows.

F-27