WeightWatchers 2003 Annual Report Download - page 67

Download and view the complete annual report

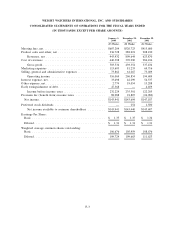

Please find page 67 of the 2003 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

2. Summary of Significant Accounting Policies (Continued)

Reclassification:

Certain prior year amounts have been reclassified to conform to the current year presentation.

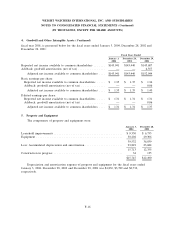

3. Acquisitions

All acquisitions have been accounted for under the purchase method of accounting and,

accordingly, earnings have been included in the consolidated operating results of the Company since

the date of acquisition. During fiscal 2003 and 2002, the Company acquired certain assets of its

franchises as outlined below.

On November 30, 2003, the Company completed the acquisition of certain assets of two of its

franchisees, Weight Watchers of Dallas, Inc. and Pedebud, Inc. (d/b/a Weight Watchers of Northern

New Mexico), pursuant to the terms of a combined asset purchase agreement with these two entities

(collectively ‘‘Dallas/New Mexico’’) and the Company. The purchase price was $27,200 plus assumed

liabilities of $300, and was allocated to franchise rights ($26,874), property and equipment ($412), and

inventory ($214). The acquisition was financed through cash from operations. Pro forma results of

operations, assuming this acquisition had been completed at the beginning of fiscal 2002 would not

differ materially from the reported results.

Effective March 30, 2003, the Company completed the acquisition of certain assets of eight of the

fifteen franchises of The WW Group, Inc. and its affiliates (the ‘‘WW Group’’) pursuant to the terms

of an Asset Purchase Agreement executed on March 31, 2003 among the WW Group, The WW Group

East L.L.C., The WW Group West L.L.C., Cuida Kilos, S.A. de C.V., Weight Watchers North

America, Inc. and the Company. The purchase price for the acquisition was $180,700 plus assumed

liabilities of $448 and acquisition costs of $866. The Company completed the purchase price allocation

in the fourth quarter of 2003 as follows: franchise rights ($177,128), inventory ($2,741), prepaid

expenses ($36) and property and equipment ($2,109). The acquisition was financed through cash and

additional borrowings of $85,000 under a new Term Loan D under the Company’s Credit Facility, as

amended on April 1, 2003 (as defined in Note 6).

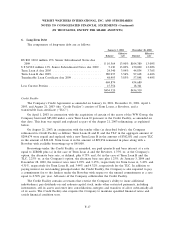

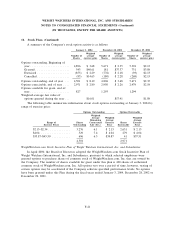

The following table presents unaudited pro forma financial information that reflects the

consolidated operations of the Company and the acquired franchises of the WW Group as if the

acquisition had occurred as of the beginning of the respective periods. The pro forma financial

information does not give effect to any synergies that might result nor any discontinued expenses from

the acquisition of the WW Group. Such discontinued expenses are estimated by management to be

approximately $3,300 and $12,000 for the years ended January 3, 2004 and December 28, 2002,

respectively. These expenses relate to corporate expenses of the owners of the WW Group and other

indirect expenses of non-acquired franchises for the periods detailed below. This pro forma information

F-13