WeightWatchers 2003 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2003 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Globally across our current markets, there is significant

opportunity to drive our growth using multiple revenue levers.

We continue to drive our penetration of the overweight

population. We continue to grow our product sales as we share

our best practices across our diverse geographies. We see

significant opportunities to smartly leverage our dominant

global brand through licensing. Because of our unique business

model, we are able to maintain our high gross margins over

varying demand levels, and

through effective marketing

and G&A cost containment,

sustain high operating margins

and cash flow.

In the course of our history, we have faced competition

from a variety of diet methodologies. In each case, we have

met the competitive challenge successfully and learned a

great deal from each new competitor. In 2003, we faced an

unusually large challenge from the low-carb, self-help

approach to weight loss. Some of these self-help

programs were built on poorly researched pseudo-

science, but even when a diet is rooted in sound

medical science, self-help dieting is limited.

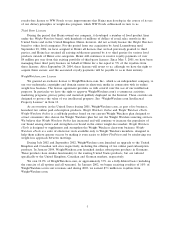

Our track record translated into

excellent EPS growth. In 2003, our

earnings per diluted share increased

by 21%, excluding a third quarter

charge for the early extinguishment

of debt.

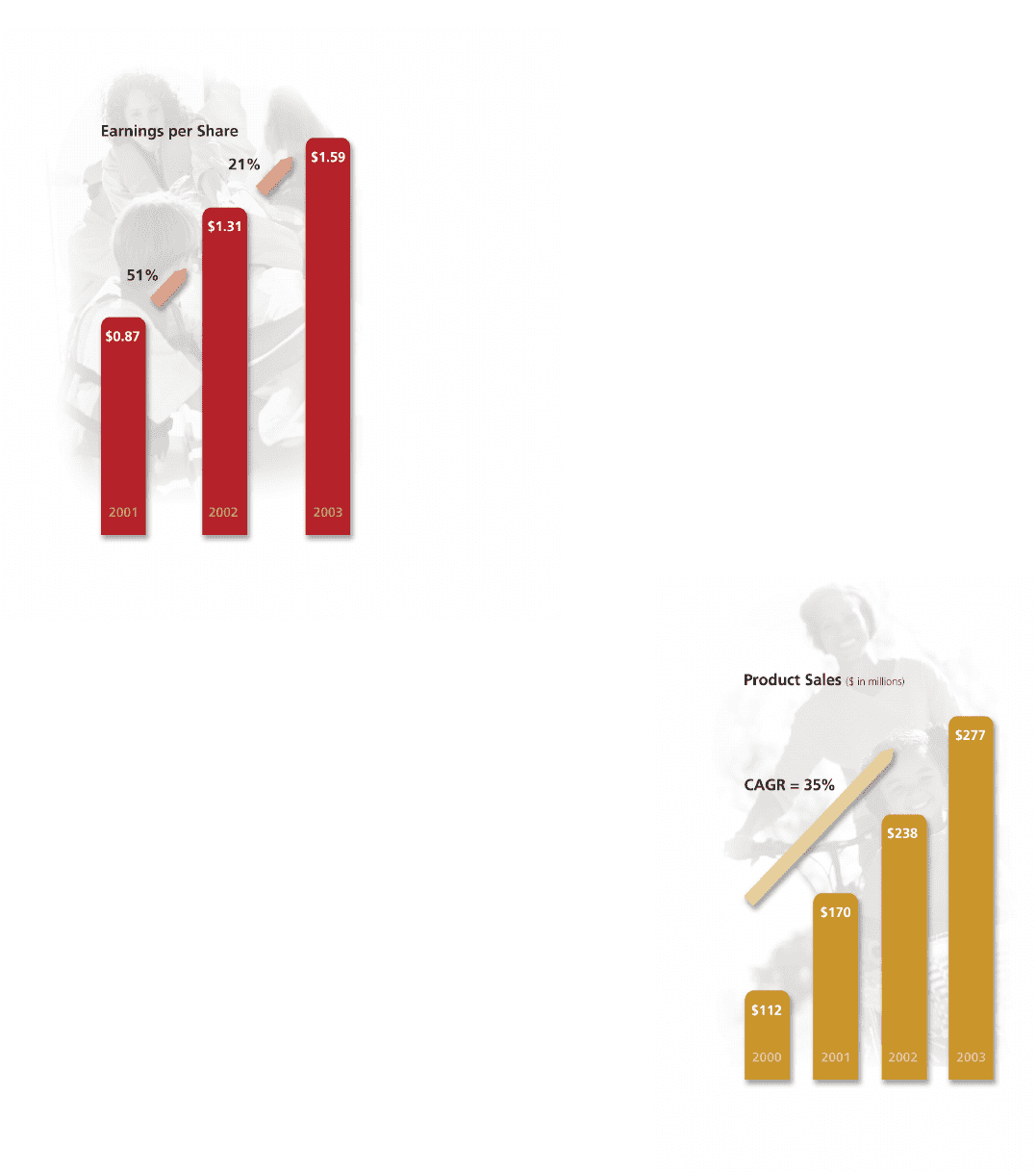

Product sales fall into three

categories: One-time-purchase

products such as electronic POINTS®

calculators or pedometers,

once-per-membership-cycle

products like our POINTS®and

eating out guides or cookbooks,

and every-week products such

as consumables. Since 2000,

product sales have grown at a

compound annual rate of 35%.