WeightWatchers 2003 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2003 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

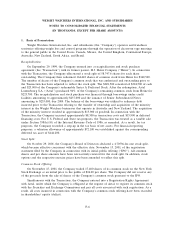

2. Summary of Significant Accounting Policies (Continued)

Recently Issued Accounting Standards:

In April 2002, the FASB issued SFAS No. 145, ‘‘Rescission of FASB Statements No. 4, 44, and 64,

Amendment of FASB No. 13 and Technical Corrections.’’ SFAS No. 145 rescinds SFAS No. 4, which

required all gains and losses from the extinguishment of debt to be classified as an extraordinary item,

and amends other existing authoritative pronouncements to make various technical corrections, clarify

meanings, or describe their applicability under changed conditions. The provisions of SFAS No. 145

became effective for the Company beginning December 29, 2002. In accordance with these provisions,

the fiscal 2001 charge for the early extinguishment of debt, which was previously reported as an

extraordinary item, has been reclassified.

In December 2003, the Financial Accounting Standards Board issued Interpretation No. 46R,

‘‘Consolidation of Variable Interest Entities,’’ (‘‘FIN 46R’’). FIN 46R replaces the same titled FIN 46

that was issued in January 2003. FIN 46R identifies when entities must be consolidated with the

financial statements of a company where the investors in an entity do not have the characteristics of a

controlling financial interest or the entity does not have sufficient equity at risk for the entity to finance

its activities without additional subordinated financial support. The provisions of this interpretation are

effective for the Company beginning the first quarter of fiscal 2004.

The Company has evaluated its relationship with its franchisees and based on this guidance,

determined they are not variable interest entities and therefore will not be consolidated with the

Company’s results. The Company is in the process of assessing its relationship with its licensee,

WeightWatchers.com, with respect to FIN 46R. The Company has not reached a conclusion on this

matter. Should the Company conclude that WeightWatchers.com is a variable interest entity meeting

the requirements of FIN 46R it would be required to consolidate it. As of December 31, 2003,

WeightWatchers.com had total assets of $21.1 million, total stockholders’ deficit of $23.0 million, and

an accumulated deficit of $27.0 million. For the year ended December 31, 2003, WeightWatchers.com

had net income of $5.4 million.

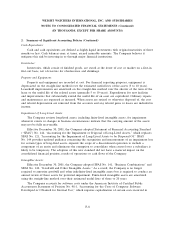

In April 2003, the FASB issued SFAS No. 149. This statement amends and clarifies financial

accounting and reporting for derivative instruments including certain derivative instruments embedded

in other contracts and for hedging activities under SFAS No. 133. This statement is effective for

contracts entered into or modified after June 30, 2003 and hedging relationships designated after

June 30, 2003. The Company has applied the provisions of SFAS No. 149 and its adoption has not had

a material impact on the Company’s consolidated financial position, results of operations or cash flows.

In May 2003, the Emerging Issue Task Force (‘‘EITF’’) reached a consensus on EITF Issue

No. 01-8, ‘‘Determining Whether an Arrangement Contains a Lease.’’ EITF Issue No. 01-8 requires

companies to perform a review of all arrangements or contracts that traditionally were not viewed as

leases to determine if they contain features that would require them to be accounted for under FASB

No. 13, ‘‘Accounting for Leases.’’ For calendar year—end companies, EITF Issue No. 01-8 was effective

July 1, 2003. The assessment of whether an arrangement contains a lease should be determined at

inception of the arrangement based on all of the facts and circumstances surrounding the arrangement

and also is required when any modification or change is made to an existing contractual arrangement.

The adoption of EITF Issue No. 01-8 did not have a material impact on the Company’s consolidated

financial position, results of operations or cash flows.

F-12