WeightWatchers 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

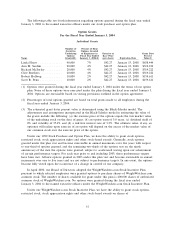

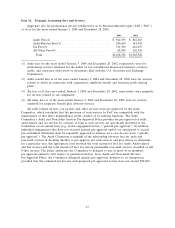

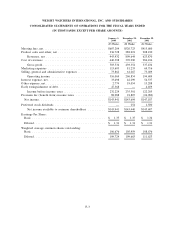

Item 14. Principal Accounting Fees and Services

Aggregate fees for professional services rendered for us by PricewaterhouseCoopers LLP (‘‘PwC’’)

as of or for the years ended January 3, 2004 and December 28, 2002:

2003 2002

Audit Fees(1) ................................. $ 942,195 $ 862,365

Audit-Related Fees(2) ........................... 286,169 181,410

Tax Fees(3) ................................... 331,390 416,657

All Other Fees(4) .............................. 68,580 102,510

Total ...................................... $1,628,334 $1,562,942

(1) Audit fees for the years ended January 3, 2004 and December 28, 2002, respectively, were for

professional services rendered for the audits of our consolidated financial statements, statutory

audits, and assistance with review of documents filed with the U.S. Securities and Exchange

Commission.

(2) Audit related fees as of the years ended January 3, 2004 and December 28, 2002 were for services

related to audits in connection with acquisitions, employee benefit and franchise profit sharing

plans.

(3) Tax fees as of the years ended January 3, 2004 and December 28, 2002, respectively, were primarily

for services related to tax compliance.

(4) All other fees as of the years ended January 3, 2004 and December 28, 2002 were for services

rendered for employee benefit plan advisory services.

All audit related services, tax services and other services were pre-approved by the Audit

Committee, which concluded that the provision of such services by PwC was compatible with the

maintenance of that firm’s independence in the conduct of its auditing functions. The Audit

Committee’s Audit and Non-Audit Services Pre-Approval Policy provides for pre-approval of audit,

audit-related and tax services by category so long as such services are specifically described to the

Committee on an annual basis (e.g., in the engagement letter) (‘‘general pre-approval’’). In addition,

individual engagements that have not received general pre-approval and/or are anticipated to exceed

pre-established thresholds must be separately approved in advance on a case-by-case basis (‘‘specific

pre-approval’’). The Audit Committee is mindful of the relationship between fees for audit and

non-audit services in deciding whether to pre-approve any such services and may choose to determine,

for a particular year, the appropriate ratio between the total amount of fees for Audit, Audit-related

and Tax services and the total amount of fees for certain permissible non-audit services classified as All

Other services. The policy authorizes the Committee to delegate to one or more of its members

pre-approval authority with respect to permitted services. In its Audit and Non-Audit Services

Pre-Approval Policy, the Committee delegated specific pre-approved authority to its chairperson,

provided that the estimated fee for any such proposed pre-approved service does not exceed $50,000.

47