WeightWatchers 2003 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2003 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

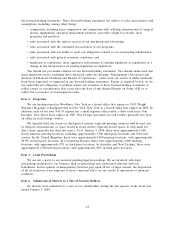

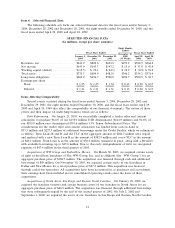

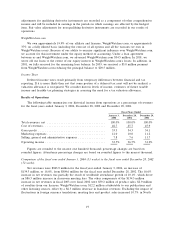

Item 6. Selected Financial Data

The following schedule sets forth our selected financial data for the fiscal years ended January 3,

2004, December 28, 2002 and December 29, 2001, the eight months ended December 30, 2000, and the

fiscal years ended April 29, 2000 and April 24, 1999.

SELECTED FINANCIAL DATA

(In millions, except per share amounts)

Eight Months

Ended

Fiscal Years Ended Fiscal Years Ended

December 30,

January 3, December 28, December 29, 2000 April 29, April 24,

2004 2002 2001 (35 Weeks) 2000 1999

Revenues, net ................... $943.9 $809.6 $623.9 $273.2 $399.5 $364.6

Net income ..................... $143.9 $143.7 $147.2 $ 15.0 $ 37.8 $ 47.9

Working capital (deficit) ............ $(19.5) $ 22.1 $(24.1) $ 10.2 $ (0.9) $ 91.2

Total assets ..................... $770.7 $609.9 $482.9 $346.2 $334.2 $371.4

Long-term obligations .............. $469.9 $454.7 $500.0 $496.7 $500.5 $ 16.7

Earnings per share:

Basic ........................ $1.35 $ 1.35 $ 1.34 $ 0.13 $ 0.20 $ 0.17

Diluted ....................... $1.31 $ 1.31 $ 1.31 $ 0.13 $ 0.20 $ 0.17

Items Affecting Comparability

Several events occurred during the fiscal years ended January 3, 2004, December 28, 2002 and

December 29, 2001, the eight months ended December 30, 2000, and the fiscal years ended April 29,

2000 and April 24, 1999 that affect the comparability of our financial statements. The nature of these

events and their impact on underlying business trends are as follows:

Debt Refinancing. On August 21, 2003, we successfully completed a tender offer and consent

solicitation to purchase 96.6% of our $150.0 million USD denominated ($144.9 million) and 91.6% of

our A100.0 million euro denominated (A91.6 million) 13% Senior Subordinated Notes. The

consideration for the tender offer and consent solicitation was funded from cash on hand of

$57.3 million and $227.3 million of additional borrowings under the Credit Facility, which we refinanced

as follows: Term Loans B and D and the TLC in the aggregate amount of $204.7 million were repaid

and replaced with a new Term Loan B in the amount of $382.9 million and a new TLC in the amount

of $49.1 million. Term Loan A in the amount of $30.0 million remained in place, along with a Revolver

with available borrowings up to $45.0 million. Due to this early extinguishment of debt, we recognized

expenses of $47.4 million in the third quarter of 2003.

Acquisitions of WW Group and Dallas/New Mexico. On March 30, 2003, we acquired certain assets

of eight of the fifteen franchises of The WW Group, Inc. and its affiliates (the ‘‘WW Group’’) for an

aggregate purchase price of $180.7 million. The acquisition was financed through cash and additional

borrowings of $85 million. On November 30, 2003, we acquired certain assets of our franchises in

Dallas and New Mexico for a total purchase price of $27.2 million. This acquisition was financed

through cash from operations. All acquisitions have been accounted for as purchases and accordingly,

their earnings have been included in our consolidated operating results since the dates of their

acquisitions.

Acquisitions of North Jersey, San Diego and Eastern North Carolina. On January 18, 2002, we

acquired the franchise territory and certain business assets of our franchise in North Jersey for an

aggregate purchase price of $46.5 million. The acquisition was financed through additional borrowings

that were subsequently repaid by the end of the second quarter of 2002. On July 2, 2002 and

September 1, 2002, we acquired the assets of our franchises in San Diego and Eastern North Carolina

14