WeightWatchers 2003 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2003 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

compared to 52 weeks in fiscal 2002, with the additional week falling in the fourth quarter of 2003. The

decrease was partially offset by lower accrued interest of $6.2 million resulting from lower interest

charges in the fourth quarter due to the debt refinancing completed in September 2003.

Capital spending has averaged approximately $4.6 million annually over the last three years and

has consisted primarily of leasehold improvements, furniture and equipment for meeting locations and

information system expenditures.

Long-Term Debt

Our Credit Facility consists of Term Loans, a revolving line of credit (‘‘Revolver’’) and a

transferable loan certificate (‘‘TLC’’). Our total debt was $469.9 million and $454.7 million at

January 3, 2004 and December 28, 2002, respectively. In fiscal 2003, we successfully completed a tender

offer and consent solicitation to purchase 96.6% of our $150.0 million USD denominated

($144.9 million) and 91.6% of our A100.0 million euro denominated (A91.6 million) 13% Senior

Subordinated Notes. The consideration for the tender offer and consent solicitation was funded from

cash on hand of $57.3 million and $227.3 million of additional borrowings under the Credit Facility,

which we refinanced as follows: Term Loans B and D and the TLC in the aggregate amount of

$204.7 million were repaid and replaced with a new Term Loan B in the amount of $382.9 million and

a new TLC in the amount of $49.1 million. Term Loan A in the amount of $30.0 million remained in

place, along with a Revolver with available borrowings of up to $45.0 million. At January 3, 2004 the

total debt balance under our Credit Facility was $454.2 million, and including the balance of

untendered Senior Subordinated Notes, total debt was $469.9 million. In conjunction with the tender

offer, we solicited consents to eliminate substantially all of the restrictive covenants and certain default

provisions in the indentures pursuant to which the Notes were issued.

Our debt consists of both fixed and variable-rate instruments. At January 3, 2004, December 28,

2002 and December 29, 2001, fixed-rate debt constituted approximately 3.3%, 56.0% and 50.3% of our

total debt, respectively. The average interest rate on our debt was approximately 3.7%, 9.1% and 8.6%

at January 3, 2004, December 28, 2002 and December 29, 2001, respectively.

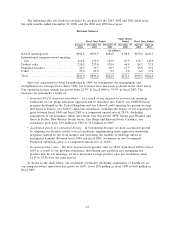

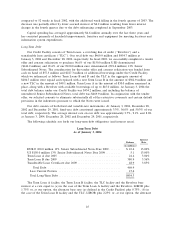

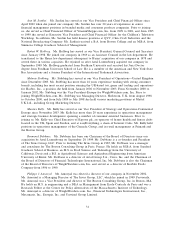

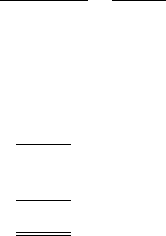

The following schedule sets forth our long-term debt obligations (and interest rates).

Long-Term Debt

As of January 3, 2004

Interest

Balance Rate

(in millions)

EURO 100.0 million 13% Senior Subordinated Notes Due 2009 ....... $ 10.6 13.00%

US $150.0 million 13% Senior Subordinated Notes Due 2009 ......... 5.1 13.00%

Term Loan A due 2005 .................................... 24.4 3.04%

Term Loan B due 2009 .................................... 380.9 3.56%

Transferable Loan Certificate due 2009 ......................... 48.9 3.85%

Total Debt .......................................... 469.9

Less Current Portion .................................... 15.6

Total Long-Term Debt .................................... $454.3

The Term Loan A facility, the Term Loan B facility, the TLC facility and the Revolver bear

interest at a rate equal to (a) in the case of the Term Loan A facility and the Revolver, LIBOR plus

1.75% or, at our option, the alternate base rate (as defined in the Credit Facility) plus 0.75%, (b) in

the case of the Term Loan B facility and the TLC, LIBOR plus 2.25% or, at our option, the alternate

25