WeightWatchers 2003 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2003 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

adjustments for qualifying derivative instruments are recorded as a component of other comprehensive

income and will be included in earnings in the periods in which earnings are affected by the hedged

item. Fair value adjustments for non-qualifying derivative instruments are recorded in our results of

operations.

WeightWatchers.com

We own approximately 19.9% of our affiliate and licensee, WeightWatchers.com, or approximately

37% on a fully diluted basis (including the exercise of all options and all the warrants we own in

WeightWatchers.com). Because of our ability to exercise significant influence over WeightWatchers.com,

we account for this investment under the equity method of accounting. Under a loan agreement

between us and WeightWatchers.com, we advanced WeightWatchers.com $34.5 million. In 2001, we

wrote off our loans to the extent of our equity interest in WeightWatchers.com’s losses. In addition, in

2001, we fully reserved for the remaining loan balance. In 2003, we received a $5.0 million payment

from WeightWatchers.com reducing the principal balance to $29.5 million.

Income Taxes

Deferred income taxes result primarily from temporary differences between financial and tax

reporting. If it is more likely than not that some portion of a deferred tax asset will not be realized, a

valuation allowance is recognized. We consider historic levels of income, estimates of future taxable

income and feasible tax planning strategies in assessing the need for a tax valuation allowance.

Results of Operations

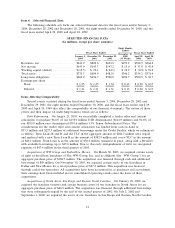

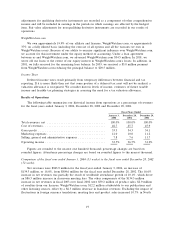

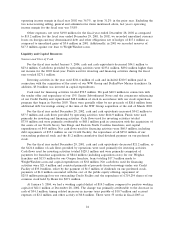

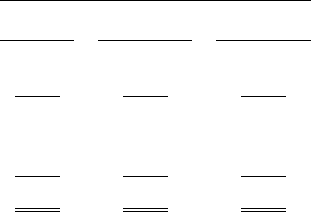

The following table summarizes our historical income from operations as a percentage of revenues

for the fiscal years ended January 3, 2004, December 28, 2002 and December 29, 2001.

Fiscal Years Ended

January 3, December 28, December 29,

2004 2002 2001

Total revenues, net .................................. 100.0% 100.0% 100.0%

Cost of revenues .................................... 46.7 45.7 45.9

Gross profit ....................................... 53.3 54.3 54.1

Marketing expenses .................................. 12.0 10.0 11.2

Selling, general and administrative expenses ................ 7.8 7.6 11.7

Operating income ................................... 33.5% 36.7% 31.2%

Figures are rounded to the nearest one hundred thousand; percentage changes are based on

rounded figures. Attendance percentage changes are based on rounded figures to the nearest thousand.

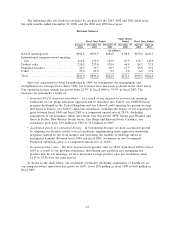

Comparison of the fiscal year ended January 3, 2004 (53 weeks) to the fiscal year ended December 28, 2002

(52 weeks).

Net revenues were $943.9 million for the fiscal year ended January 3, 2004, an increase of

$134.3 million, or 16.6%, from $809.6 million for the fiscal year ended December 28, 2002. The 16.6%

increase in net revenues was partially the result of worldwide attendance growth of 10.1%, which drove

an $86.5 million increase in classroom meeting fees. The other components of the $134.3 million

increase in net revenues in fiscal 2003 over fiscal 2002 were $39.2 million of product sales, $2.9 million

of royalties from our licensee, WeightWatchers.com, $12.2 million attributable to our publications and

other licensing sources, offset by a $6.5 million decrease in franchise revenues. Excluding the impact of

fluctuations in foreign currency translations, meeting fees and product sales increased 10.7% in North

19