WeightWatchers 2003 Annual Report Download - page 64

Download and view the complete annual report

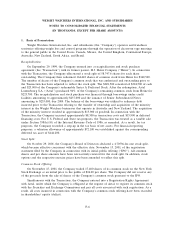

Please find page 64 of the 2003 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

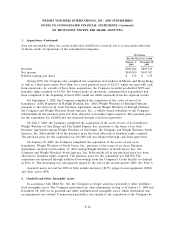

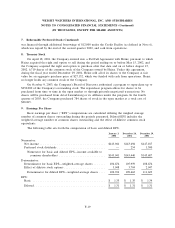

2. Summary of Significant Accounting Policies (Continued)

Certain Derivative Instruments and Certain Hedging Activities’’ and SFAS No. 149, ‘‘Amendment of

Statement on Derivative Instruments and Hedging Activities.’’ These standards require that all

derivative financial instruments be recorded on the consolidated balance sheets at their fair value as

either assets or liabilities. Changes in the fair value of derivatives are recorded each period in earnings

or accumulated other comprehensive income (loss), depending on whether a derivative is designated as

effective as part of a hedge transaction and, if it is, the type of hedge transaction. Gains and losses on

derivative instruments reported in accumulated other comprehensive income (loss) will be included in

earnings in the periods in which earnings are affected by the hedged item. As of December 31, 2000,

the adoption of these new standards resulted in an adjustment of $5,086 ($3,204 net of taxes) to

accumulated other comprehensive income (loss). The receivable or payable associated with derivative

contracts is included in the balance of prepaid expenses or accounts payable, respectively.

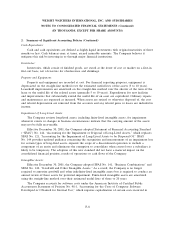

Investments:

The Company uses the cost method to account for investments in which it holds 20% or less of

the investee’s voting stock and over which it does not have significant influence. When the Company

holds 50% or less of the investee’s voting stock and has the ability to exercise significant influence over

operating and financial policies of the investee, the investment is accounted for under the equity

method.

Deferred Financing Costs:

Deferred financing costs consist of fees paid by the Company as part of the establishment,

exchange and/or modification of the Company’s long-term debt. During the fiscal year ended January 3,

2004, the Company incurred additional deferred financing costs of $2,366 associated with the

refinancing of its Credit Facility. Such costs are being amortized using the interest rate method over the

term of the related debt. Amortization expense for the fiscal years ended January 3, 2004,

December 28, 2002 and December 29, 2001 was $1,248, $1,313 and $2,097, respectively. In connection

with the early extinguishment of its Senior Subordinated Notes, the Company wrote off $4,387 of

deferred financing costs in the fiscal year ended January 3, 2004. Additionally, in connection with the

refinancing of its Credit Facility, the Company wrote off $4,659 of deferred financing costs in the fiscal

year ended December 29, 2001. These amounts have been recorded as a component of operating

income. See Note 6 for details of the refinancing.

Comprehensive Income (Loss):

Comprehensive income (loss) represents the change in shareholders’ equity (deficit) resulting from

transactions other than shareholder investments and distributions. The Company’s comprehensive

income (loss) includes net income, changes in the fair value of derivative instruments and the effects of

foreign currency translations. At January 3, 2004 and December 28, 2002, the cumulative balance of

changes in fair value of derivative instruments is ($270) and ($2,675), respectively As of January 3, 2004

and December 28, 2002, the cumulative balance of the effects of foreign currency translations is $6,536

and ($1,198) respectively.

F-10