WeightWatchers 2003 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2003 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

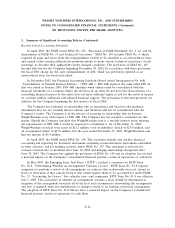

4. Goodwill and Other Intangible Assets (Continued)

the H.J. Heinz Company in 1978. The balance in goodwill remained unchanged from December 29,

2001 to December 28, 2002. The goodwill balance increased during the fiscal year ended January 3,

2004 primarily due to a small foreign acquisition. Franchise rights acquired are due mainly to

acquisitions of the Company’s franchised territories. Prior to fiscal 2002, goodwill and other indefinite-

lived intangible assets were being amortized on a straight-line basis over periods ranging from 3 to

40 years. Amortization of goodwill and other indefinite-lived intangibles for the fiscal year ended

December 29, 2001 was $9,782.

Also, in accordance with SFAS No. 142, aggregate amortization expense for finite lived intangible

assets was recorded in the amounts of $1,062, $951 and $729 for the fiscal years ended January 3, 2004,

December 28, 2002 and December 29, 2001, respectively.

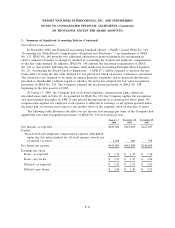

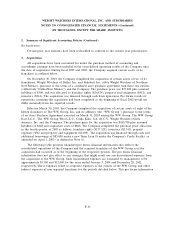

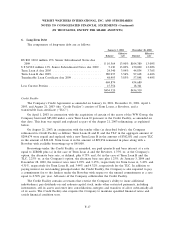

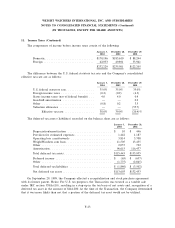

The carrying amount of amortized intangible assets as of January 3, 2004 and December 28, 2002

was as follows:

January 3, 2004 December 28, 2002

Gross Gross

Carrying Accumulated Carrying Accumulated

Amount Amortization Amount Amortization

Deferred software cost ......................... $1,879 $ 1,206 $ 1,260 $ 869

Trademarks ................................. 7,600 6,879 7,223 6,674

Non-compete agreement ........................ 1,200 875 1,200 575

Other ...................................... 4,003 3,268 3,985 3,197

$14,682 $12,228 $13,668 $11,315

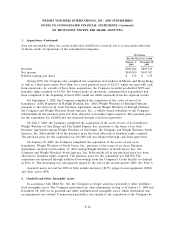

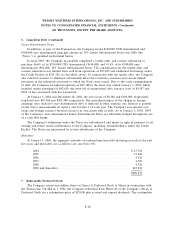

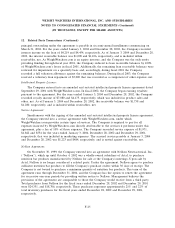

Estimated amortization expense of finite lived intangible assets for the next five fiscal years is as

follows:

2004...................................................... $896

2005...................................................... $429

2006...................................................... $291

2007...................................................... $172

2008...................................................... $ 98

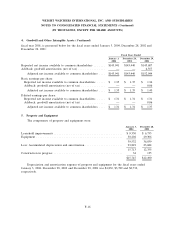

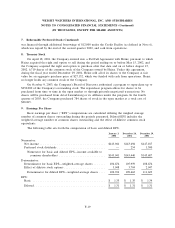

As required by SFAS No. 142, the results for the fiscal year ended December 29, 2001 have not

been restated. A reconciliation of net income, as if SFAS No. 142 had been adopted at the beginning of

F-15