WeightWatchers 2003 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2003 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

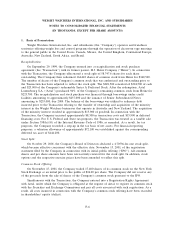

2. Summary of Significant Accounting Policies (Continued)

Stock Based Compensation:

In December 2002, the Financial Accounting Standards Board, (‘‘FASB’’) issued SFAS No. 148,

‘‘Accounting for Stock-Based Compensation—Transition and Disclosure,’’—an amendment of SFAS

No. 123. SFAS No. 148 provides two additional alternative transition methods for recognizing an

entity’s voluntary decision to change its method of accounting for stock-based employee compensation

to the fair value method. In addition, SFAS No. 148 amends the disclosure requirements of SFAS

No. 123 so that entities following the intrinsic value method of Accounting Principles Board Opinion

No. 25, ‘‘Accounting for Stock Issued to Employees,’’ (‘‘APB 25’’) will be required to disclose the pro

forma effect of using the fair value method for any period for which an income statement is presented.

The disclosures are required to be made in annual financial statements and in quarterly information

provided to shareholders without regard to whether the entity has adopted the fair value recognition

provisions of SFAS No. 123. The Company adopted the disclosure provisions of SFAS No. 148

beginning in the first quarter of 2003.

At January 3, 2004, the Company had stock-based employee compensation plans, which are

described more fully in Note 10. As permitted by SFAS No. 123, the Company applies the recognition

and measurement principles of APB 25 and related Interpretations in accounting for those plans. No

compensation expense for employee stock options is reflected in earnings, as all options granted under

the plans had an exercise price equal to the market value of the common stock on the date of grant.

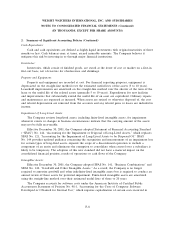

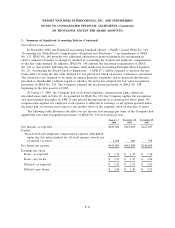

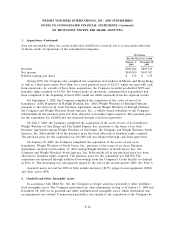

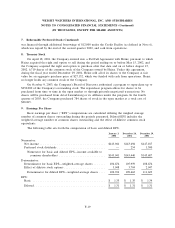

The following table illustrates the effect on net income and earnings per share if the Company had

applied the fair value recognition provisions of SFAS No. 123 in each fiscal year:

January 3, December 28, December 29,

2004 2002 2001

Net income, as reported .............................. $143,941 $143,694 $147,187

Deduct:

Total stock-based employee compensation expense determined

under the fair value method for all stock options awards, net

of related tax effect .............................. 2,036 696 558

Pro forma net income ................................ $141,905 $142,998 $146,629

Earnings per share:

Basic—as reported ................................ $ 1.35 $ 1.35 $ 1.34

Basic—pro forma ................................. $ 1.33 $ 1.35 $ 1.34

Diluted—as reported ............................... $ 1.31 $ 1.31 $ 1.31

Diluted—pro forma ................................ $ 1.29 $ 1.30 $ 1.31

F-11