WeightWatchers 2003 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2003 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

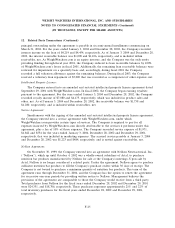

11. Income Taxes (Continued)

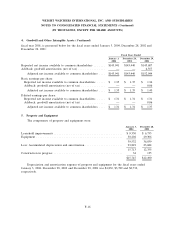

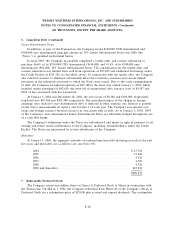

The components of income before income taxes consist of the following:

January 3, December 28, December 29,

2002 2002 2001

Domestic ............................ $170,196 $185,610 $ 88,244

Foreign ............................. 62,033 49,891 33,961

$232,229 $235,501 $122,205

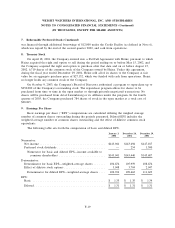

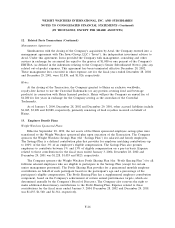

The difference between the U.S. federal statutory tax rate and the Company’s consolidated

effective tax rate are as follows:

January 3, December 28, December 29,

2004 2002 2001

U.S. federal statutory rate ................ 35.0% 35.0% 35.0%

Foreign income taxes ................... (0.2) (0.2) (4.3)

States income taxes (net of federal benefit) . . . 4.0 4.0 0.9

Goodwill amortization .................. — — 0.2

Other .............................. (0.8) 0.2 3.5

Valuation allowance .................... — — (55.7)

Effective tax rate ................. 38.0% 39.0% (20.4)%

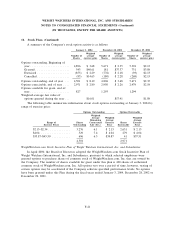

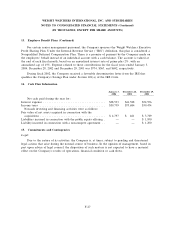

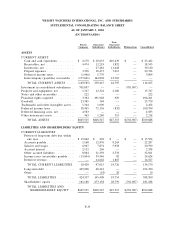

The deferred tax assets (liabilities) recorded on the balance sheet are as follows:

January 3, December 28,

2004 2002

Depreciation/amortization ......................... $ 10 $ 446

Provision for estimated expenses ..................... 1,442 1,187

Operating loss carryforwards ....................... 3,814 3,708

WeightWatchers.com loan .......................... 11,505 13,455

Other ........................................ 2,057 722

Amortization ................................... 96,615 116,437

Total deferred tax assets ........................... $115,443 $135,955

Deferred income ................................ $ (65) $ (637)

Other ........................................ (1,775) (2,865)

Total deferred tax liabilities ........................ $ (1,840) $ (3,502)

Net deferred tax assets ............................ $113,603 $132,453

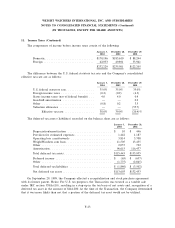

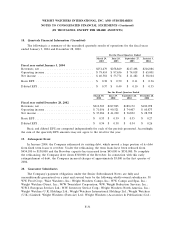

On September 29, 1999, the Company effected a recapitalization and stock purchase agreement

with its former parent, Heinz. For U.S. tax purposes, the Transaction was treated as a taxable sale

under IRC section 338(h)(10), resulting in a step-up in the tax basis of net assets and, recognition of a

deferred tax asset in the amount of $144,200. At the time of the Transaction, the Company determined

that it was more likely than not that a portion of the deferred tax asset would not be utilized.

F-23