WeightWatchers 2003 Annual Report Download - page 30

Download and view the complete annual report

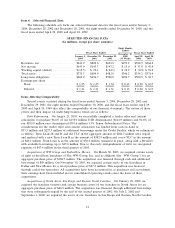

Please find page 30 of the 2003 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.operating income margin in fiscal year 2002 was 36.7%, up from 31.2% in the prior year. Excluding the

two non-recurring selling, general and administrative items mentioned above, last year’s operating

income margin for the fiscal year was 33.8%.

Other expenses, net were $19.0 million for the fiscal year ended December 28, 2002 as compared

to $13.2 million for the fiscal year ended December 29, 2001. In 2002, we recorded unrealized currency

losses on foreign currency denominated debt and other obligations net of hedges of $17.1 million as

compared to unrealized gains of $5.4 million in 2001. Additionally, in 2001 we recorded reserves of

$17.3 million against our loan to WeightWatchers.com.

Liquidity and Capital Resources

Sources and Uses of Cash

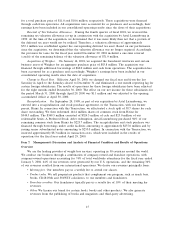

For the fiscal year ended January 3, 2004, cash and cash equivalents decreased $34.1 million to

$23.4 million. Cash flows provided by operating activities were $233.1 million, $89.2 million higher than

net income for the 2003 fiscal year. Funds used for investing and financing activities during the fiscal

year totaled $271.1 million.

Investing activities in the year used $211.6 million of cash and included $210.5 million paid in

connection with the acquisition of the assets of our WW Group and Dallas/New Mexico franchises. In

addition, $5.0 million was invested in capital expenditures.

Cash used for financing activities totaled $59.5 million. We paid $60.3 million in connection with

the tender offer and repurchase of our 13% Senior Subordinated Notes and the concurrent refinancing

of our Credit Facility and repurchased $28.8 million of stock in accordance with our stock repurchase

program that began in October 2003. These were partially offset by net proceeds of $26.6 million from

additional debt borrowings arising at the time of the WW Group acquisition at the end of March 2003.

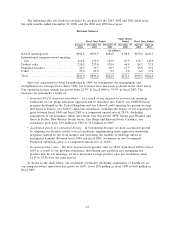

For the fiscal year ended December 28, 2002, cash and cash equivalents increased $34.2 million to

$57.5 million and cash flows provided by operating activities were $164.9 million. Funds were used

primarily for investing and financing activities. Cash flows used for investing activities totaled

$73.9 million and were primarily attributable to $68.1 million paid in connection with the acquisition of

the assets of our North Jersey, San Diego and Eastern North Carolina franchises, and capital

expenditures of $4.9 million. Net cash flows used for financing activities were $60.5 million, including

debt repayments of $35.3 million on our Credit Facility, the repurchase of all $25.0 million of our

outstanding preferred stock and the $1.2 million cumulative final dividend payment on our preferred

stock.

For the fiscal year ended December 29, 2001, cash and cash equivalents decreased $21.2 million, as

the $121.6 million of cash flows provided by operations were used primarily for investing activities.

Cash flows used for investing activities totaled $120.1 million and were primarily comprised of

payments for franchise acquisitions of $84.4 million (including acquisition costs) for our Weighco

franchise and $13.5 million for our Oregon franchise, loans totaling $17.3 million made to

WeightWatchers.com and capital expenditures of $3.8 million. Net cash flows used for financing

activities were $21.4 million and consisted primarily of proceeds from borrowings under our Credit

Facility of $35.0 million, offset by the payment of $1.5 million of dividends on our preferred stock,

payments of $1.0 million associated with the cost of the public equity offering, repayment of

$25.8 million principal on our outstanding Credit Facility and the repurchase of 6,719,254 shares of our

common stock held by Heinz for $27.1 million.

At January 3, 2004, we had a working capital deficit of $19.5 million compared to positive working

capital of $22.1 million at December 28, 2002. The change was primarily attributable to the decrease in

cash of $34.1 million, timing related increases in income taxes payable of $10.7 million and accrued

expenses of $2.2 million and other activity of $0.8 million. There were 53 weeks in fiscal 2003 as

24