WeightWatchers 2003 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2003 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

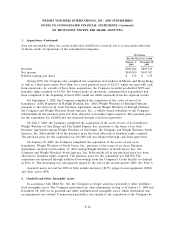

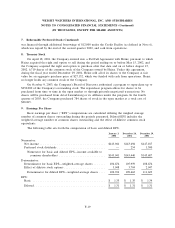

7. Redeemable Preferred Stock (Continued)

was financed through additional borrowings of $12,000 under the Credit Facility (as defined in Note 6),

which was repaid by the end of the second quarter 2002, and cash from operations.

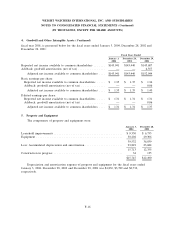

8. Treasury Stock

On April 18, 2001, the Company entered into a Put/Call Agreement with Heinz, pursuant to which

Heinz acquired the right and option to sell during the period ending on or before May 15, 2002, and

the Company acquired the right and option to purchase after that date and on or before August 15,

2002, 6,719 shares of the common stock of the Company owned by Heinz. Under this agreement,

during the fiscal year ended December 29, 2001, Heinz sold all of its shares to the Company at fair

value for an aggregate purchase price of $27,132, which was funded with cash from operations. Heinz

no longer holds any common stock of the Company.

On October 9, 2003, the Company’s Board of Directors authorized a program to repurchase up to

$250,000 of the Company’s outstanding stock. The repurchase program allows for shares to be

purchased from time to time in the open market or through privately negotiated transactions. No

shares will be purchased from Artal Luxembourg or its affiliates under the program. In the fourth

quarter of 2003, the Company purchased 784 shares of stock in the open market at a total cost of

$28,815.

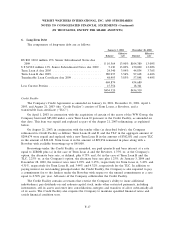

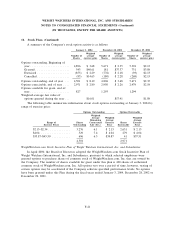

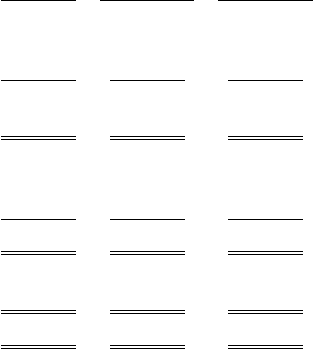

9. Earnings Per Share

Basic earnings per share (‘‘EPS’’) computations are calculated utilizing the weighed average

number of common shares outstanding during the periods presented. Diluted EPS includes the

weighted average number of common shares outstanding and the effect of dilutive common stock

equivalents.

The following table sets forth the computation of basic and diluted EPS.

January 3, December 28, December 29,

2004 2002 2001

Numerator:

Net income ...................................... $143,941 $143,694 $147,187

Preferred stock dividends ............................ — 254 1,500

Numerator for basic and diluted EPS—income available to

common shareholders ........................... $143,941 $143,440 $145,687

Denominator:

Denominator for basic EPS—weighted-average shares ....... 106,676 105,959 108,676

Effect of dilutive stock options ........................ 3,048 3,704 2,947

Denominator for diluted EPS—weighted-average shares .... 109,724 109,663 111,623

EPS:

Basic .......................................... $ 1.35 $ 1.35 $ 1.34

Diluted ......................................... $ 1.31 $ 1.31 $ 1.31

F-19