WeightWatchers 2003 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2003 WeightWatchers annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.WEIGHT WATCHERS INTERNATIONAL, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

(IN THOUSANDS, EXCEPT PER SHARE AMOUNTS)

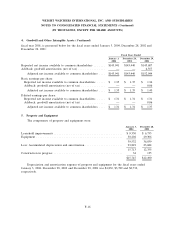

12. Related Party Transactions (Continued)

Management Agreement:

Simultaneous with the closing of the Company’s acquisition by Artal, the Company entered into a

management agreement with The Invus Group, LLC (‘‘Invus’’), the independent investment advisor to

Artal. Under this agreement, Invus provided the Company with management, consulting and other

services in exchange for an annual fee equal to the greater of $1,000 or one percent of the Company’s

EBITDA (as defined in the indentures relating to the Company’s Senior Subordinated Notes), plus any

related out-of-pocket expenses. This agreement has been terminated effective December 28, 2002.

These management fees, recorded in other expense, net for the fiscal years ended December 28, 2002

and December 29, 2001, were $2,838, and $1,926, respectively.

Heinz:

At the closing of the Transaction, the Company granted to Heinz an exclusive worldwide,

royalty-free license to use the Custodial Trademarks (or any portion covering food and beverage

products) in connection with Heinz licensed products. Heinz will pay the Company an annual fee of

$1,200 for five years in exchange for the Company serving as the custodian of the Custodial

Trademarks.

As of January 3, 2004, December 28, 2002 and December 29, 2001, other accrued liabilities include

$1,965, $3,209 and $2,888, respectively, primarily consisting of food royalties received on behalf of

Heinz.

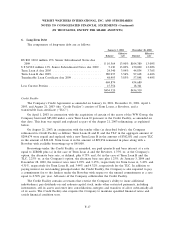

13. Employee Benefit Plans

Weight Watchers Sponsored Plans:

Effective September 29, 1999, the net assets of the Heinz sponsored employee savings plan were

transferred to the Weight Watchers sponsored plan upon execution of the Transaction. The Company

sponsors the Weight Watchers Savings Plan (the ‘‘Savings Plan’’) for salaried and hourly employees.

The Savings Plan is a defined contribution plan that provides for employer matching contributions up

to 100% of the first 3% of an employee’s eligible compensation. The Savings Plan also permits

employees to contribute between 1% and 13% of eligible compensation on a pre-tax basis. Expense

related to these contributions for the fiscal years ended January 3, 2004, December 28, 2002 and

December 29, 2001 was $1,228, $1,033 and $823, respectively.

The Company sponsors the Weight Watchers Profit Sharing Plan (the ‘‘Profit Sharing Plan’’) for all

full-time salaried employees who are eligible to participate in the Savings Plan (except for certain

senior management personnel). The Profit Sharing Plan provides for a guaranteed monthly employer

contribution on behalf of each participant based on the participant’s age and a percentage of the

participant’s eligible compensation. The Profit Sharing Plan has a supplemental employer contribution

component, based on the Company’s achievement of certain annual performance targets, which are

determined annually by the Company’s Board of Directors. The Company also reserves the right to

make additional discretionary contributions to the Profit Sharing Plan. Expense related to these

contributions for the fiscal years ended January 3, 2004, December 28, 2002 and December 29, 2001

was $1,655, $1,560, and $1,361, respectively.

F-26