Virgin Media 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

changes, the conversion rate will be increased as provided by a formula set forth in the indenture

governing the convertible senior notes.

Holders may also require us to repurchase the convertible senior notes for cash in the event of a

fundamental change (as defined in the indenture governing the convertible senior notes), such as a

change in control, merger, consolidation, dissolution or delisting (including involuntary delisting for

failure to continue to comply with the NASDAQ listing criteria), for a purchase price equal to 100% of

the principal amount, plus accrued but unpaid interest to the purchase date.

Restrictions under our Existing Debt Agreements

The agreements governing the senior notes and the senior credit facility significantly and, in some

cases absolutely, restrict our ability and the ability of most of our subsidiaries to:

• incur or guarantee additional indebtedness;

• pay dividends or make other distributions, or redeem or repurchase equity interests or

subordinated obligations;

• make investments;

• sell assets, including the capital stock of subsidiaries;

• enter into sale and leaseback transactions or certain vendor financing arrangements;

• create liens;

• enter into agreements that restrict the restricted subsidiaries’ ability to pay dividends, transfer

assets or make intercompany loans;

• merge or consolidate or transfer all or substantially all of their assets; and

• enter into transactions with affiliates.

We are also subject to financial maintenance covenants under our senior credit facility. These

covenants require us to meet certain financial targets on a quarterly basis and the required levels

increase over time. As a result, we will need to continue to improve our operating performance over

the next several years to meet these levels. Failure to meet these covenant levels would result in a

default under our senior credit facility.

Debt Ratings

To access public debt capital markets, we rely on credit rating agencies to assign corporate credit

ratings. A rating is not a recommendation by the rating agency to buy, sell or hold our securities. A

credit rating agency may change or withdraw our ratings based on its assessment of our current and

future ability to meet interest and principal repayment obligations. Lower credit ratings generally result

in higher borrowing costs and reduced access to debt capital markets. The corporate debt ratings and

outlook currently assigned by the rating agencies engaged by us are as follows:

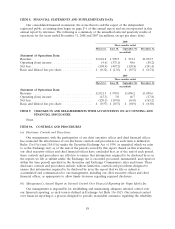

Corporate

Rating Outlook

Moody’s Investors Service Inc. ........................ Ba3 Stable

Standard & Poor’s .................................. B+ Positive

Fitch ........................................... BB– Stable

81