Virgin Media 2008 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2008 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Advertising Revenue. The majority of revenue for Virgin Media TV is from advertisers.

Consequently, Virgin Media TV’s revenue is directly affected by changes in the total spend on

television advertising in the U.K., the viewing levels for its channels and the proportion of the U.K.

advertising market represented by IDS.

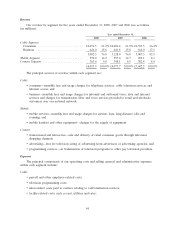

Critical Accounting Policies

Our consolidated financial statements and related financial information are based on the

application of U.S. generally accepted accounting principles, or GAAP. GAAP requires the use of

estimates, assumptions, judgments and subjective interpretations of accounting principles that have an

impact on the assets, liabilities, revenue and expense amounts reported, as well as disclosures about

contingencies, risk and financial condition. The following critical accounting policies have the potential

to have a significant impact on our financial statements. An impact could occur because of the

significance of the financial statement item to which these policies relate, or because these policies

require more judgment and estimation than other matters owing to the uncertainty related to

measuring, at a specific point in time, transactions that are continuous in nature.

These policies may need to be revised in the future in the event that changes to our business

occur.

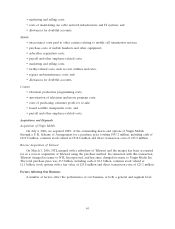

Impairment of Long-Lived Assets and Indefinite-Lived Assets

Long-lived assets and certain identifiable intangibles (intangible assets that do not have indefinite

lives) to be held and used by an entity are reviewed for impairment whenever events or changes in

circumstances indicate that the carrying amount of an asset may not be recoverable in accordance with

Financial Accounting Standards Board, or FASB, Statement No. 144, Impairment of Long-Lived Assets,

or FAS 144. Indications of impairment are determined by reviewing undiscounted projected future cash

flows. If impairment is indicated, the amount of the impairment is the amount by which the carrying

value exceeds the fair value of the assets.

Goodwill arising from business combinations, reorganization value in excess of amounts allocable

to identifiable assets and intangible assets with indefinite lives, are subject to annual review for

impairment (or more frequently should indications of impairment arise). Impairment of goodwill and

reorganization value in excess of amounts allocable to identifiable assets is determined using a two-step

approach, initially based on a comparison of the reporting unit’s fair value to its carrying value; if the

fair value is lower than the carrying value, then the second step compares the asset’s fair value (implied

fair value for goodwill and reorganization value in excess of amounts allocable to identifiable assets)

with its carrying value to measure the amount of the impairment. Impairment of intangible assets with

indefinite lives is determined based on a comparison of fair value to carrying value. Any excess of

carrying value over fair value is recognized as an impairment loss. We evaluate our Cable reporting unit

for impairment on an annual basis as at December 31, while our Mobile, Virgin Media TV and sit-up

reporting units are evaluated as at June 30. We incurred impairment charges in 2008 in respect of our

Mobile and sit-up reporting units, and we may incur further impairment charges under FASB Statement

No. 142, Accounting for Goodwill and Other Intangible Assets, or FAS 142, if market values decline and

we do not achieve expected cash flows.

While we utilize a variety of valuation techniques to determine fair value, including market

multiples and comparable transactions, estimated fair value is generally measured by discounting

estimated future cash flows. All of these techniques are reliant on our long range cash flow forecasts.

In estimating cash flows, we use financial assumptions in our internal forecasting model such as

projected customer numbers, projected product sales mix and price changes, projected changes in prices

we pay for purchases of fixed assets and services as well as projected labor costs. Considerable

management judgment is necessary to estimate discounted future cash flows and those estimates

49