Virgin Media 2008 Annual Report Download - page 69

Download and view the complete annual report

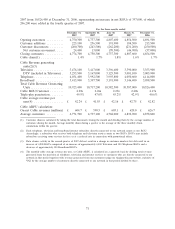

Please find page 69 of the 2008 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.disposal of investments totaling £8.1 million, offset by losses on disposal of fixed assets totaling

£18.8 million.

Interest expense

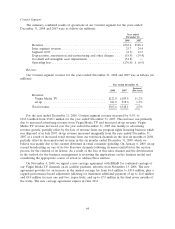

For the year ended December 31, 2007, interest expense increased to £514.2 million from

£457.4 million for the year ended December 31, 2006, primarily due to the additional borrowings

resulting from the reverse acquisition of Telewest and the acquisition of Virgin Mobile.

We paid cash interest of £486.9 million for the year ended December 31, 2007 and £327.1 million

for the year ended December 31, 2006. The increase in cash interest payments resulted from the

additional borrowings following the reverse acquisition of Telewest and the acquisition of Virgin

Mobile, and changes in the timing of interest payments.

Loss on extinguishment of debt

For the year ended December 31, 2007, loss on extinguishment of debt was £3.2 million which

related to the write off of deferred financing costs as a result of our partial repayments under our

senior credit facility. For the year ended December 31, 2006, loss on extinguishment of debt was

£32.8 million which related primarily to the write off of deferred financing costs on our previous senior

credit facility that was repaid upon completion of the refinancing of the reverse acquisition of Telewest.

Share of income from equity investments

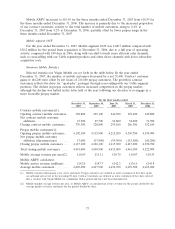

For the year ended December 31, 2007, share of income from equity investments was £17.7 million

as compared with income of £12.5 million for the same period in 2006. The income from equity

investments in the year ended December 31, 2007 was largely comprised of our proportionate share of

the income earned by UKTV. The increase in our proportionate share of the income earned by UKTV

was primarily due to the inclusion of UKTV within our Content segment only from March 3, 2006

following the reverse acquisition of Telewest as compared with its inclusion for a full year in 2007,

together with an increase in UKTV’s net income in 2007 resulting primarily from additional advertising

revenue.

(Loss) gain from derivative instruments

The loss from derivative instruments of £2.5 million in the year ended December 31, 2007,

primarily related to unrealized losses on cross-currency interest rate swaps not designated as hedges

partially offset by hedge ineffectiveness on certain interest rate swaps. The gain from derivative

instruments of £1.3 million in the year ended December 31, 2006 related primarily to favorable mark to

market movements in the fair value of derivative instruments not designated as hedges.

Foreign currency gains (losses)

For the year ended December 31, 2007, foreign currency gains were £5.1 million as compared with

losses of £90.1 million for the same period in 2006. The foreign currency gains in the year ended

December 31, 2007 were largely comprised of favorable exchange rate movements in our U.S. dollar

denominated debt and payables. The foreign currency losses in the year ended December 31, 2006 were

largely comprised of foreign exchange losses of £70.8 million on U.S. dollar forward purchase contracts

that were entered into to economically mitigate the foreign currency risk relating to the repayment of

our U.S. dollar denominated bridge facility. The repayment of $3.1 billion of this facility on June 19,

2006 resulted in an offsetting gain during the period of £120.7 million that was recorded as a

component of equity.

67