Virgin Media 2008 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2008 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Note 8—Long Term Debt (Continued)

the conversion rate will be increased as provided by a formula set forth in the indenture governing the

convertible senior notes.

Holders may also require us to repurchase the convertible senior notes for cash in the event of a

fundamental change for a purchase price equal to 100% of the principal amount, plus accrued but

unpaid interest to the purchase date.

In May 2008, the FASB issued Staff Position No. APB 14-1, Accounting for Convertible Debt

Instruments that may be Settled in Cash Upon Conversion, or FSP APB 14-1. FSP APB 14-1 requires

that the liability and equity components of convertible debt instruments that may be settled in cash

upon conversion (including partial cash settlement) be separately accounted for in a manner that

reflects an issuer’s nonconvertible debt borrowing rate. As a result, the liability component would be

recorded at a discount reflecting its below market coupon interest rate, and would subsequently be

accreted to its par value over its expected life, with the rate of interest that reflects the market rate at

issuance being reflected in the results of operations. This change in methodology will affect the

calculations of net income and earnings per share, but will not increase our cash interest payments.

FSP APB 14-1 is effective for financial statements issued for fiscal years beginning after December 15,

2008, and interim periods within those fiscal years. Retrospective application to all periods presented is

required and early adoption is prohibited. Our convertible senior notes are within the scope of FSP

APB 14-1. As such, we have assessed the impact of adopting FSP APB 14-1 and have determined that

we will apply a nonconvertible borrowing rate of 10.35% resulting in a discount on the convertible

senior notes totaling £108.2 million being recognized with an offsetting amount being recognized as a

component of additional paid-in capital. The additional interest expense and related tax impact that the

application of this standard has on our consolidated statement of operations is as follows (in millions,

except per share data):

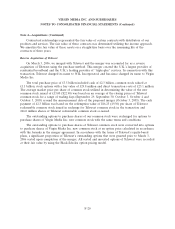

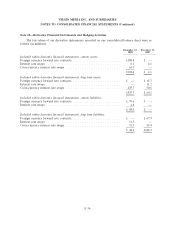

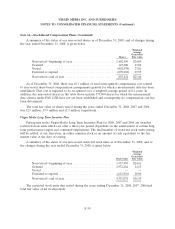

Year ended December 31, 2008

As As

Reported Adjustments Adjusted

Interest expense ........................... (493.3) (6.2) (499.5)

Income tax benefit ......................... 6.8 — 6.8

Net loss ................................. (913.8) (6.2) (920.0)

Net loss per share:

Basic and diluted .......................... (2.79) (0.02) (2.81)

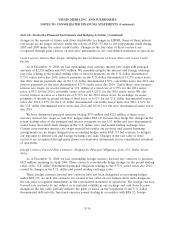

Senior Credit Facility

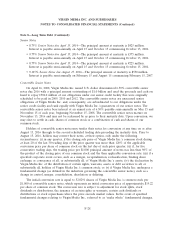

The principal amount outstanding under our senior credit facility at December 31, 2008 was

£4,189.4 million. Our senior credit facility comprises a term facility denominated in a combination of

pounds sterling, U.S. dollars and euros in aggregate principal amounts of £3,421.9 million,

$531.9 million and A423.9 million, and a revolving facility of £100.0 million. At December 31, 2008, the

sterling equivalent of £4,189.4 million of the term facility had been drawn and £21.3 million of the

revolving credit facility had been utilized for bank guarantees and standby letters of credit.

The senior credit facility bears interest at LIBOR, US LIBOR or EURIBOR plus a margin

currently ranging from 1.625% to 3.625% and the applicable cost of complying with any reserve

F-29