Virgin Media 2008 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2008 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

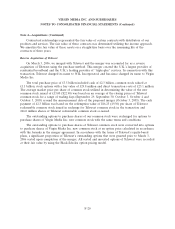

Note 4—Acquisitions (Continued)

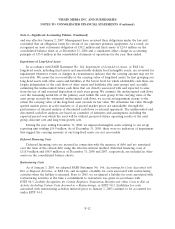

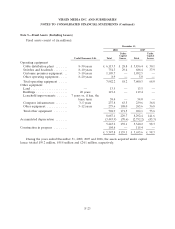

The total purchase price was allocated as follows (in millions):

Acquisition

Date

Cash and cash equivalents, including restricted cash ................ £ 303.2

Accounts receivable ....................................... 155.6

Prepaid expenses and other current assets ....................... 36.5

Fixed assets ............................................. 2,932.9

Inventory ............................................... 34.8

Investments in and loans to affiliates ........................... 377.9

Amortizable intangible assets:

Customer lists .......................................... 761.6

Tradenames ............................................ 10.7

Licenses .............................................. 37.0

Intangible assets with indefinite lives:

Goodwill .............................................. 1,370.1

Tradenames ............................................ 16.5

Accounts payable ......................................... (144.7)

Long term debt, including current portion ....................... (1,873.7)

Other current liabilities ..................................... (453.9)

Other long term liabilities ................................... (38.5)

Deferred income taxes ..................................... (77.0)

Total purchase price ....................................... £3,449.0

Amortizable intangible assets

Of the total purchase price, £809.3 million was allocated to amortizable intangible assets including

customer lists, tradenames and licenses. Customer lists represented existing contracts that related

primarily to underlying customer relationships pertaining to the services provided by Telewest. The fair

value of these assets was determined utilizing the income approach. We amortize the fair value of these

assets on a straight-line basis over estimated useful lives of between three and six years.

Tradenames represented the Telewest and BlueYonder brand names. The fair value of these assets

was determined utilizing a relief-from-royalty method. We amortize the fair value of these assets on a

straight-line basis over estimated useful lives of between one and nine years.

Licenses represented contracts to broadcast television content over a digital broadcasting system in

the U.K. The fair value of these contracts was determined utilizing the income approach. We amortize

the fair value of these assets on a straight-line basis over an average estimated useful life of four years.

Indefinite life intangible assets

Tradenames with indefinite lives represented the Living, Bravo and Challenge television channel

names. We determined that these assets have indefinite lives as the tradenames do not expire and

management expect the related cash flows to continue indefinitely. Therefore, these assets are not

being amortized until their useful life is deemed to no longer be indefinite.

F-21