Virgin Media 2008 Annual Report Download - page 108

Download and view the complete annual report

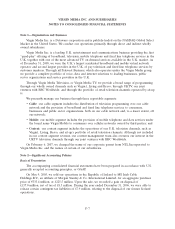

Please find page 108 of the 2008 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Note 2—Significant Accounting Policies (Continued)

Bundled services revenue is recognized in accordance with the provisions of EITF No 00-21,

Accounting for Revenue Arrangements with Multiple Deliverables, to assess whether the components of the

bundled services should be recognized separately.

For bundled packages that have separately identifiable components, the total consideration is

allocated to the different components based on their relative fair values. Where the fair value of a

delivered component cannot be determined reliably but the fair value of the undelivered component

can be, the fair value of the undelivered component is deducted from the total consideration and the

net amount is allocated to the delivered components based on the ‘‘residual value’’ method.

Programming revenues are recognized in accordance with SOP 00-2, Accounting by Producers or

Distributors of Films. Revenue on transactional and interactive sales is recognized as and when the

services are delivered. Advertising sales revenue is recognized at estimated realizable values when the

advertising is aired.

Retail revenues are recognized on dispatch of goods to customers and are net of discounts given

and less actual and expected returns, refunds and credit card charge-backs.

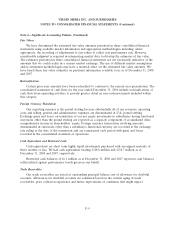

Subscriber Acquisition Costs

Costs incurred in respect to the acquisition of customers of our Mobile segment, including

payments to distributors and the cost of handset promotions, are expensed as incurred.

Advertising Expense

We expense the cost of advertising as incurred. Advertising costs were £100.3 million,

£108.6 million and £101.3 million in 2008, 2007 and 2006, respectively.

Stock-Based Compensation

We have a number of stock-based employee compensation plans, as described more fully in

note 11. On December 16, 2004, the FASB issued Statement No. 123 (revised 2004), Share Based

Payment, or FAS 123R, which is a revision of FASB Statement No. 123, Accounting for Stock-Based

Compensation, or FAS 123. FAS 123R also supersedes APB 25 and amends FASB Statement No. 95,

Statement of Cash Flows, or FAS 95. FAS 123R differs from FAS 123 by requiring all entities to

measure liabilities incurred in stock-based payment transactions at fair value and to estimate the

number of instruments for which the requisite service period is expected to be rendered rather than

accounting for forfeitures as they occur. Under FAS 123R, modifications to the terms or conditions of

an award are measured by comparing the fair value of the modified award with the fair value of the

award immediately before the modification, as opposed to measuring the effects of a modification as

the difference between the fair value of the modified award at the date it is granted and the fair value

of the awards immediately before the modification.

FAS 123R also clarifies and expands guidance under FAS 123 including the measurement of fair

value, classifying an award as either equity or as a liability and attributing compensation cost to

reporting periods. FAS 123R amends FAS 95 requiring that the excess tax benefits are reported as a

financing cash inflow rather than as a reduction of taxes paid.

F-14