Virgin Media 2008 Annual Report Download - page 78

Download and view the complete annual report

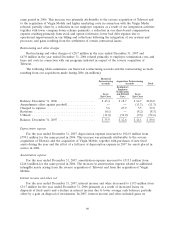

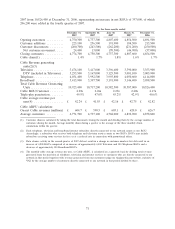

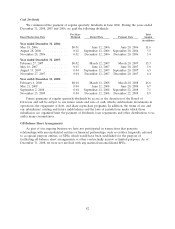

Please find page 78 of the 2008 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Cash used in financing activities for the year ended December 31, 2007 was £302.5 million

compared with cash provided by financing activities of £1,865.2 million for the year ended

December 31, 2006. For the year ended December 31, 2007, the principal uses of cash were the partial

repayments of our senior credit facility and capital lease payments, totaling £1,170.8 million, and the

principal components of cash provided by financing activities were new borrowings under our senior

credit facility, net of financing fees, of £874.5 million. For the year ended December 31, 2006, the

principal components of cash provided by financing activities were the new £5.3 billion senior credit

facility and the $550 million senior notes due 2016, and the principal uses of cash were the repayment

of our previous senior credit and bridge facilities utilizing the new borrowings and cash provided by

operations. See further discussion under Liquidity and Capital Resources—Senior Credit Facility.

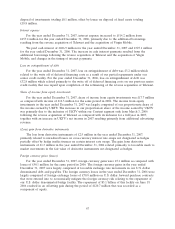

Liquidity and Capital Resources

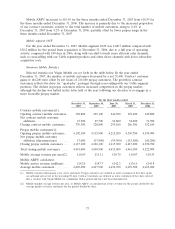

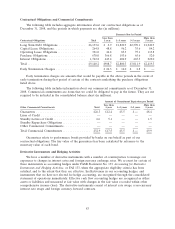

As of December 31, 2008, we had £6,308.2 million of debt outstanding, compared to

£6,198.3 million as of September 30, 2008 and £5,958.5 million as of December 31, 2007, and

£181.6 million of cash and cash equivalents, compared to £521.4 million as of September 30, 2008 and

£321.4 million as of December 31, 2007. The increase in debt since the previous year is primarily

attributable to a £590.0 million unfavorable exchange rate movement on our debt denominated in

currencies other than the pound sterling together with a greater use of finance leases. This was partially

offset by a £300.0 million voluntary prepayment of our senior credit facility in December 2008 from

existing cash balances.

Our business is capital intensive and we are highly leveraged. We have significant cash

requirements for operating costs, capital expenditures and interest expense. We also have significant

principal payments under our senior credit facility due in 2010-2012, as described below. The level of

our capital expenditures and operating expenditures are affected by the significant amounts of capital

required to connect customers to our network, expand and upgrade our network and offer new services.

We expect that our cash on hand, together with cash from operations and amounts undrawn on our

revolving credit facility, will be sufficient for our cash requirements through December 31, 2009.

However, our cash requirements after December 31, 2009 may exceed these sources of cash.

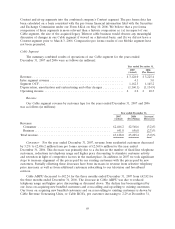

Significant principal payments under our senior credit facility are due in 2010 and 2011. However,

in November 2008, we amended the terms of our senior credit facility to defer a significant portion of

these payments to 2012. The deferral is conditional on us prepaying a further £187.0 million under our

senior credit facility prior to August 2009. We believe that we should be able to meet this prepayment

condition using cash flow from operations and, if required, from amounts undrawn on our revolving

credit facility. Assuming the prepayment condition is satisfied, we expect to be able to address the

remaining scheduled principal payments in 2010 and 2011 through cash flow from operations. However,

if we were unable to meet the prepayment condition or service these obligations through cash flow

from operations, then we would need to secure additional funding such as raising additional debt or

equity, refinancing our existing facility, selling assets or using other means. We may not be able to

obtain financing or sell assets, at all or on favorable terms, or we may be contractually prevented by the

terms of our senior notes or our senior credit facility from incurring additional indebtedness or selling

assets.

Once the payment condition is satisfied, we will have significant principal payments due in 2012

under our senior credit facility that we can address only by a comprehensive refinancing of our senior

debt and possibly other debt instruments. Our ability to implement such a refinancing successfully is

significantly dependent on material improvements in the debt markets.

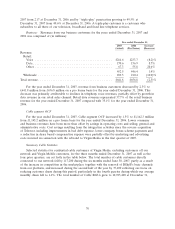

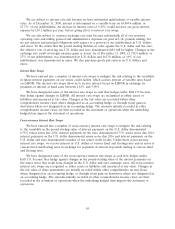

Our long term debt was issued by Virgin Media Inc. and certain of its subsidiaries that have no

independent operations or significant assets other than investments in their respective subsidiaries. As a

result, they will depend upon the receipt of sufficient funds from their respective subsidiaries to meet

76