Virgin Media 2008 Annual Report Download - page 61

Download and view the complete annual report

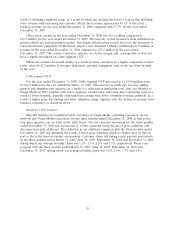

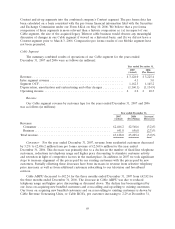

Please find page 61 of the 2008 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.result of declining telephony usage, as a result of which our strategy has been to replace this declining

voice revenue with increasing data revenue. Retail data revenue represented 43.1% of the retail

business revenue for the year ended December 31, 2008 compared with 37.7% for the year ended

December 31, 2007.

Other retail revenue in the year ended December 31, 2008 was £61.6 million compared to

£67.3 million for the year ended December 31, 2007. The majority of this revenue is from infrastructure

projects which are non-recurring in nature. Our largest infrastructure project has been the provision of

telecoms network equipment for Heathrow airport’s new Terminal 5 which contributed £21.0 million of

revenue in the year ended December 31, 2008 compared to £27.9 million in the year ended

December 31, 2007. This contract, however, operates at a lower margin and, consequently, it does not

have a significant impact on Cable segment OCF.

Wholesale revenue decreased mainly as a result of fewer customers in a highly competitive market

partly offset by £2.5 million of stronger than usual customer equipment sales in the last three months

of the year.

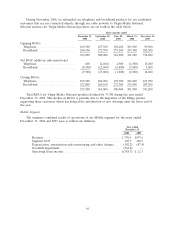

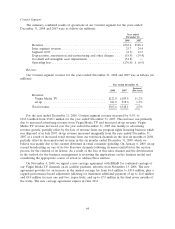

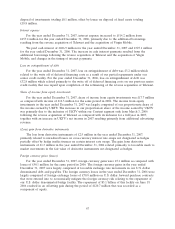

Cable segment OCF

For the year ended December 31, 2008, Cable segment OCF increased to £1,199.0 million from

£1,162.3 million for the year ended December 31, 2007. This increase is partly due to lower selling,

general and administrative expenses as a result of a reduction in marketing costs after our rebrand to

Virgin Media in 2007 together with lower employee related costs, and lower direct operating costs as a

result of lower revenues. Partially offsetting these savings were lower consumer revenue, primarily as a

result of higher price discounting and lower telephony usage, together with the decline in revenue from

business customers, as described above.

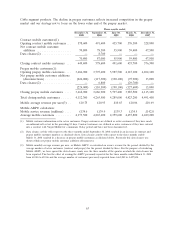

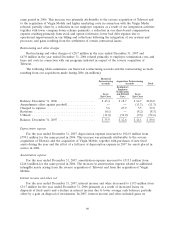

Summary Cable Statistics

Selected statistics for residential cable customers of Virgin Media, excluding customers off our

network and Virgin Mobile customers, for the three months ended December 31, 2008 as well as the

four prior quarters, are set forth in the table below. Our net customer movement for the three months

ended December 31, 2008 was an increase of 14,800 customers being the net of gross additions and

disconnections (net additions). The reduction in net additions compared with the three months ended

December 31, 2007 was primarily the result of fewer gross additions which we believe may be due in

part to the softer macroeconomic environment. Customer churn fell during recent periods, particularly

in the three months ended March 31, 2008, June 30, 2008, September 30, 2008 and December 31, 2008

during which our average monthly churn was 1.2%, 1.3%, 1.5% and 1.2%, respectively. These rates

compare with the three months ended March 31, 2007, June 30, 2007, September 30, 2007 and

December 31, 2007, during which our average monthly churn was 1.6%, 1.8%, 1.7% and 1.4%,

59