Virgin Media 2008 Annual Report Download - page 147

Download and view the complete annual report

Please find page 147 of the 2008 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Note 16—Shareholders’ Equity (Continued)

our subsidiaries’ existing and future indebtedness and the laws of jurisdictions under which those

subsidiaries are organized limit the payment of dividends, loan repayments and other distributions to us

under many circumstances.

Series A Warrants

On January 10, 2003, we issued Series A warrants to some of our former creditors and

stockholders. The Series A warrants were initially exercisable for a total of 8,750,496 shares of common

stock at an exercise price of $309.88 per share. After adjustment to account for the rights offering and

the reverse acquisition of Telewest in accordance with anti-dilution adjustment provisions, the Series A

warrants are exercisable for a total of 25,769,060 shares of our common stock at an exercise price of

$105.17 per share. The Series A warrants expire on January 10, 2011. The agreement governing the

Series A warrants is governed by New York law. The Series A warrants are listed on the NASDAQ

Global Select Market under the symbol ‘‘VMEDW.’’ The Series A warrants may be subject to further

change.

Note 17—Commitments and Contingent Liabilities

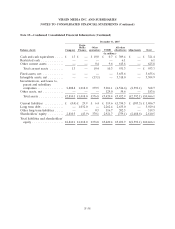

At December 31, 2008, we were committed to pay £678.0 million for equipment and services. This

amount includes £311.2 million for operations and maintenance contracts and other commitments from

January 1, 2010 to 2016. The aggregate amount of the fixed and determinable portions of these

obligations for the succeeding five fiscal years and thereafter is as follows (in millions):

Year ending December 31:

2009 ..................................................... £366.8

2010. .................................................... 105.2

2011. .................................................... 88.4

2012. .................................................... 45.1

2013. .................................................... 20.5

Thereafter ................................................ 52.0

£678.0

We are involved in lawsuits, claims, investigations and proceedings, consisting of intellectual

property, commercial, employee and employee benefits which arise in the ordinary course of our

business. In accordance with FASB Statement No. 5, Accounting for Contingencies, or FAS 5, we

recognize a provision for a liability when management believes that it is both probable that a liability

has been incurred and the amount of the loss can be reasonably estimated. We believe we have

adequate provisions for any such matters. We review these provisions at least quarterly and adjust these

provisions to reflect the impact of negotiations, settlements, rulings, advice of legal counsel and other

information and events pertaining to a particular case. Whilst litigation is inherently unpredictable, we

believe that we have valid defenses with respect to legal matters pending against us. Nevertheless, it is

possible that cash flows or results of operations could be materially affected in any particular period by

the unfavorable resolution of one or more of these contingencies, or because of the diversion of

management’s attention and the creation of significant expenses.

F-53