Virgin Media 2008 Annual Report Download - page 189

Download and view the complete annual report

Please find page 189 of the 2008 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Note 9—Fair Value Measurements (Continued)

FAS 157 defines fair value as the price that would be received to sell an asset or paid to transfer a

liability in an orderly transaction between market participants at the measurement date (exit price).

FAS 157 classifies the inputs used to measure fair value into the following hierarchy:

Level 1 Unadjusted quoted prices in active markets for identical assets or liabilities

Level 2 Unadjusted quoted prices in active markets for similar assets or liabilities, or

Unadjusted quoted prices for identical or similar assets or liabilities in markets that are

not active, or

Inputs other than quoted prices that are observable for the asset or liability

Level 3 Unobservable inputs for the asset or liability

We endeavor to utilize the best available information in measuring fair value. Financial assets and

liabilities are classified in their entirety based on the lowest level of input that is significant to the fair

value measurement. We have determined that all of our financial assets and liabilities that are stated at

fair value fall in levels 1 and 2 in the fair value hierarchy described above.

In estimating the fair value of our other financial instruments, we used the following methods and

assumptions:

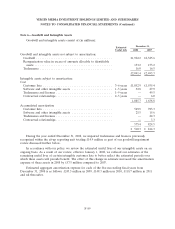

Cash and cash equivalents, and restricted cash: The carrying amounts reported in the consolidated

balance sheets approximate fair value due to the short maturity and nature of these financial

instruments.

Derivative financial instruments: As a result of our financing activities, we are exposed to market

risks from changes in interest and foreign currency exchange rates, which may adversely affect our

operating results and financial position. When deemed appropriate, we minimize our risks from interest

and foreign currency exchange rate fluctuations through the use of derivative financial instruments. The

foreign currency forward rate contracts, interest rate swaps and cross-currency interest rate swaps are

valued using broker quotations, or market transactions in either the listed or over-the counter markets,

adjusted for non-performance risk. As such, these derivative instruments are classified within level 2 in

the fair value hierarchy. The carrying amounts of our derivative financial instruments are disclosed in

note 10.

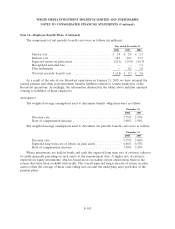

Long term debt: The fair value of our senior credit facility is based upon quoted trading priced in

inactive markets for this debt, which incorporates non-performance risk. The fair values of our other

debt in the following table are based on the quoted market prices for the underlying third party debt

and incorporates non-performance risk. Accordingly, the inputs used to value the debt instruments are

classified within level 1 of the fair value hierarchy.

F-95