Virgin Media 2008 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2008 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.interests’’) to be clearly identified, presented, and disclosed in the consolidated statement of financial

position within equity, but separate from the parent’s equity. All changes in the parent’s ownership

interests are required to be accounted for consistently as equity transactions and any non-controlling

equity investments in unconsolidated subsidiaries must be measured initially at fair value. FAS 160 is

effective, on a prospective basis, for fiscal years beginning after December 15, 2008; however,

presentation and disclosure requirements must be retrospectively applied to comparative financial

statements. While we are still addressing the impact of the adoption of FAS 160, it is not expected to

have a material impact on our consolidated financial statements.

In March 2008, the FASB issued Statement No. 161, Disclosures about Derivative Instruments and

Hedging Activities—an Amendment of FASB Statement No. 133, or FAS 161, which amends and expands

the disclosure requirements of FASB Statement No. 133, Accounting for Derivative Instruments and

Hedging Activities, or FAS 133, with the intent to provide users of financial statements with an enhanced

understanding of: (1) how and why an entity uses derivative instruments; (2) how derivative instruments

and related hedged items are accounted for under FAS 133 and its related interpretations; and (3) how

derivative instruments and related hedged items affect an entity’s financial position, financial

performance and cash flows. FAS 161 requires qualitative disclosures about objectives and strategies for

using derivatives, quantitative disclosures about fair value amounts of and gains and losses on derivative

instruments and disclosures about credit-risk-related contingent features in derivative instruments.

FAS 161 applies to all entities and all derivative instruments and is effective for financial statements

issued for fiscal years and interim periods beginning after November 15, 2008. We have not yet adopted

the provisions of FAS 161, but we do not expect it to have a material impact on our consolidated

financial statements.

In May 2008, the FASB issued Statement No. 162, The Hierarchy of Generally Accepted Accounting

Principles, or FAS 162. FAS 162 sets forth the level of authority to a given accounting pronouncement

or document by category. Where there might be conflicting guidance between two categories, the more

authoritative category will prevail. FAS 162 will become effective 60 days after the SEC approves the

PCAOB’s amendments to AU Section 411 of the AICPA Professional Standards. We do not expect

FAS 162 to have an effect on our consolidated financial statements at this time.

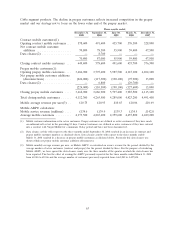

Consolidated Results of Operations

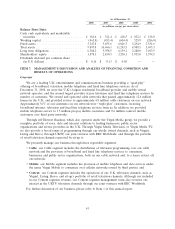

Consolidated Results of Operations for the Years Ended December 31, 2008 and 2007

Revenue

For the year ended December 31, 2008, revenue decreased by 1.4% to £4,015.9 million from

£4,073.7 million for the same period in 2007. This decrease was primarily due to lower revenue in our

Cable segment, driven by declining telephony usage and increased discounting due to increased

competition, and lower Mobile segment revenue, mainly due to lower prepay revenue as a result of

fewer customers. This reduction was partially offset by an increase in revenue in our Content segment.

See further discussion of our Cable, Mobile and Content segments below.

Expenses

Operating costs. For the year ended December 31, 2008, operating costs, including network

expenses, decreased slightly to £1,829.2 million from £1,830.0 million during the same period in 2007.

This decrease was primarily attributable to decreased operating costs in our Cable and Mobile

segments partially offset by increased operating costs in our Content segment. Lower employee,

facilities and other network costs in our Cable segment and reduced commissions and equipment costs

in our Mobile segment were partially offset by increased interconnect costs in our Mobile segment and

increased programming costs in our Content segment following the launch of our Virgin1 channel in

the fourth quarter of 2007.

53