Virgin Media 2008 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2008 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

VIRGIN MEDIA INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

Note 2—Significant Accounting Policies (Continued)

In June 2006, the FASB issued FASB Interpretation No. 48, Accounting for Uncertainty in Income

Taxes—an interpretation of FASB Statement 109, or FIN 48. FIN 48 prescribes a comprehensive model

for recognizing, measuring, presenting and disclosing in the financial statements tax positions taken or

expected to be taken on a tax return, including a decision whether to file or not to file in a particular

jurisdiction. We adopted FIN 48 on January 1, 2007. The adoption did not have a material effect on

our consolidated financial statements.

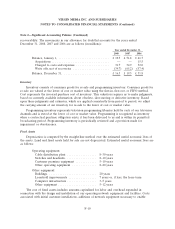

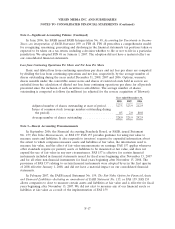

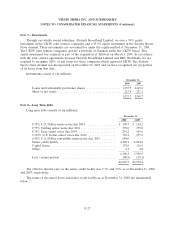

Loss from Continuing Operations Per Share and Net Loss Per Share

Basic and diluted loss from continuing operations per share and net loss per share are computed

by dividing the loss from continuing operations and net loss, respectively, by the average number of

shares outstanding during the years ended December 31, 2008, 2007 and 2006. Options, warrants,

shares issuable under the convertible senior notes and shares of restricted stock held in escrow are

excluded from the calculation of diluted net loss from continuing operations per share for all periods

presented since the inclusion of such securities is anti-dilutive. The average number of shares

outstanding is computed as follows (in millions) (as adjusted for the reverse acquisition of Telewest):

Year ended December 31,

2008 2007 2006

Adjusted number of shares outstanding at start of period .... 327.5 323.9 212.9

Issues of common stock (average number outstanding during

the period) ................................... 0.5 2.0 80.0

Average number of shares outstanding ................. 328.0 325.9 292.9

Note 3—Recent Accounting Pronouncements

In September 2006, the Financial Accounting Standards Board, or FASB, issued Statement

No. 157, Fair Value Measurements, or FAS 157. FAS 157 provides guidance for using fair value to

measure assets and liabilities. It also responds to investors’ requests for expanded information about

the extent to which companies measure assets and liabilities at fair value, the information used to

measure fair value, and the effect of fair value measurements on earnings. FAS 157 applies whenever

other standards require (or permit) assets or liabilities to be measured at fair value, and does not

expand the use of fair value in any new circumstances. FAS 157 is effective for certain financial

instruments included in financial statements issued for fiscal years beginning after November 15, 2007

and for all other non-financial instruments for fiscal years beginning after November 15, 2008. The

provisions of FAS 157 relating to certain financial instruments were adopted by us in the first quarter

of 2008 effective January 1, 2008, and did not have a material impact on our consolidated financial

statements.

In February 2007, the FASB issued Statement No. 159, The Fair Value Option for Financial Assets

and Financial Liabilities—Including an amendment of FASB Statement No. 115, or FAS 159. FAS 159

allows companies to elect to measure certain assets and liabilities at fair value and is effective for fiscal

years beginning after November 15, 2007. We did not elect to measure any of our financial assets or

liabilities at fair value as a result of the implementation of FAS 159.

F-17