Virgin Media 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.their obligations. In addition, the terms of our existing and future indebtedness and the laws of the

jurisdictions under which our subsidiaries are organized limit the payment of dividends, loan

repayments and other distributions from them under many circumstances.

Our debt agreements contain restrictions on our ability to transfer cash between groups of our

subsidiaries. As a result of these restrictions, although our overall liquidity may be sufficient to satisfy

our obligations, we may be limited by covenants in some of our debt agreements from transferring cash

to other subsidiaries that might require funds. In addition, cross default provisions in our other

indebtedness may be triggered if we default on any of these debt agreements.

Senior Credit Facility

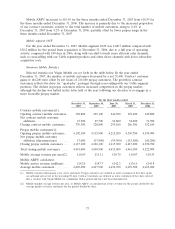

During 2006, we entered into a senior credit facility in an aggregate principal sterling equivalent

amount of £5,275 million, comprising a £3,350 million 5 year amortizing Tranche A term loan facility, a

£175 million 5 year amortizing Tranche A1 term loan facility, a £300 million 61⁄2 year bullet Tranche B1

term loan facility, a £351 million 61⁄2 year bullet Tranche B2 term loan facility, a A500 million 61⁄2 year

bullet Tranche B3 term loan facility, a $650 million 61⁄2 year bullet Tranche B4 term loan facility, a

£300 million 7 year bullet Tranche C term loan facility and a £100 million 5 year multi-currency

revolving loan facility. In April 2007, we amended the senior credit facility and borrowed an additional

£890 million under a 51⁄2 year bullet Tranche B5 term loan facility and a 51⁄2 year Tranche B6 term loan

facility and used the net proceeds to repay some of our obligations under the Tranche A and Tranche

A1 term loan facilities.

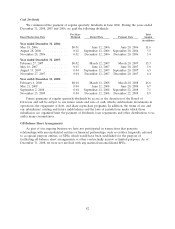

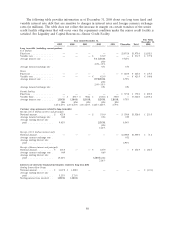

In November 2008, we further amended the senior credit facility to, among other things:

(i) subject to the repayment condition described below, defer the remaining principal

payments due to consenting lenders under the existing Tranche A and Tranche A1 term loan

facilities to June 2012, through the transfer of those lenders’ participations to new Tranche A2 and

Tranche A3 (corresponding to Tranche A and Tranche A1, respectively). While the existing

A tranches mature in March 2011, with amortization payments due in 2010 and 2011, the new

A tranches will mature in June 2012 and will have no amortization payments prior to final

maturity. In total, lenders holding 70.3% of the existing A tranches (£1,459.7 million) transferred

their participations into the new A tranches;

(ii) subject to the repayment condition described below, extend the maturity of the existing

revolving facility in respect of consenting lenders from March 2011 to June 2012, through the

transfer of those lenders’ participations to a new revolving facility. In total, lenders holding 72.3%

of the existing revolving facility transferred their participations into the new revolving facility;

(iii) suspend the right of consenting lenders under the B tranches to receive a pro rata share

of voluntary and mandatory prepayments until the outstanding amounts under all A tranches and

the existing Tranches B1 to B6 are repaid in full, through the transfer of those lenders’

participations to new Tranches B7 to B12 (corresponding to Tranches B1 to B6, respectively) which

do not have the right to pro rata prepayments. In total, lenders holding 81.6% of the existing

B tranches (£1,615.9 million) transferred their participations into the new B tranches;

(iv) provide flexibility to add tranches to the senior credit facility that will have a maturity no

earlier than September 2012, with no scheduled amortization payments prior to that date, to be

used solely to repay debt under the senior credit facility; and

(v) subject to the repayment condition described below, reset certain financial covenant

ratios.

Lenders who did not individually consent to transfer their participations to the new A tranches,

B tranches and revolving facility remained in the existing A tranches, B tranches and revolving facility.

77