Virgin Media 2008 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2008 Virgin Media annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224

|

|

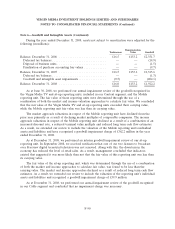

VIRGIN MEDIA INVESTMENT HOLDINGS LIMITED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

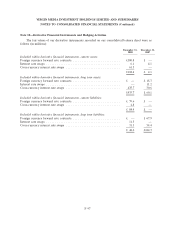

Note 10—Derivative Financial Instruments and Hedging Activities (Continued)

The foreign exchange risks relating to the $550 million 9.125% senior notes due 2016, the

A225 million senior notes due 2014 and the $531.9 million and A423.9 million principal obligations

under the senior credit facility is being mitigated through the use of cross-currency interest rate swaps,

some of which qualify as accounting hedges and some of which do not.

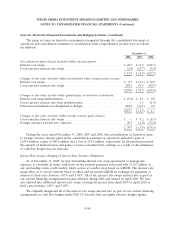

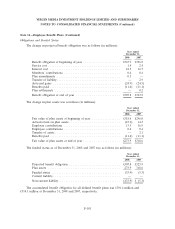

Note 11—Employee Benefit Plans

Defined Benefit Plans

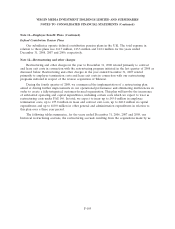

Certain of our subsidiaries operate defined benefit pension plans in the U.K. The assets of the

plans are held separately from those of ourselves and are invested in specialized portfolios under the

management of investment groups. The pension cost is calculated using the projected unit method. Our

policy is to fund amounts to the defined benefit plans necessary to comply with the funding

requirements as prescribed by the laws and regulations in the U.K. Our defined benefit pension plans

use a measurement date of December 31.

In June 2007, Virgin Media effected a merger of two of our defined benefit plans with a smaller

plan in respect of NTL Glasgow, a wholly owned subsidiary of Virgin Media but not a subsidiary of

ours (the merged plan). The merger of these plans was subject to the approval of the trustees and, as a

condition of trustee approval, Virgin Media agreed to make a specific one-time contribution of

£4.5 million. Following the merger, we have two defined benefit plans, the merged plan and the main

plan, and the information set out in the following tables and disclosure includes amounts in respect of

these two plans in total since substantially all of the plan assets and obligations relate to our current

and former employees.

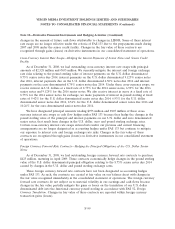

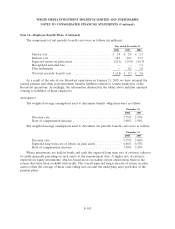

We adopted the provisions of Statement of Financial Accounting Standards No. 158, Employers’

Accounting for Defined Benefit Pension and Other Postretirement Plans, an amendment of FASB

Statements No. 87, 88, 106, and 132(R), or FAS 158, as of December 31, 2006. The table below

summarizes the incremental effects of the FAS 158 adoption on the individual line items in our balance

sheet at December 31, 2006 (in millions):

Pre FAS 158 FAS 158 Post FAS 158

Adoption Adjustment Adoption

Deferred revenue and other long term liabilities ............. £32.3 £9.4 £41.7

Accumulated other comprehensive income ................. 10.6 9.4 20.0

F-100