Tesco 2008 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2008 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

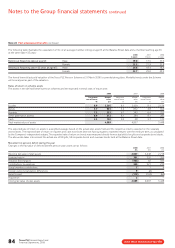

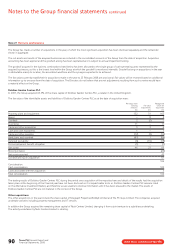

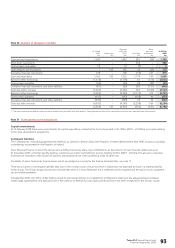

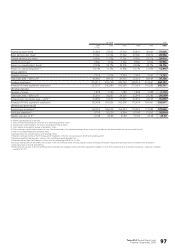

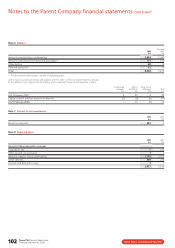

Note 32 Leasing commitments

Finance lease commitments – Group as lessee

The Group has finance leases for various items of plant, equipment, fixtures and fittings. There are also a small number of buildings which are held under

finance leases. The fair value of the Group’s lease obligations approximate to their carrying value.

Future minimum lease payments under finance leases and hire purchase contracts, together with the present value of the net minimum lease payments

are as follows:

Present value of

Minimum lease payments minimum lease payments

2008 2007 2008 2007

£m £m £m £m

Within one year 62 38 51 36

Greater than one year but less than five years 181 109 156 90

After five years 130 130 59 57

Total minimum lease payments 373 277 266 183

Less future finance charges (107) (94)

Present value of minimum lease payments 266 183

Analysed as:

Current finance lease payables 51 36

Non-current finance lease payables 215 147

266 183

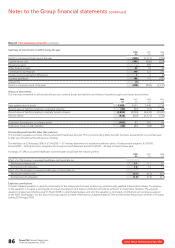

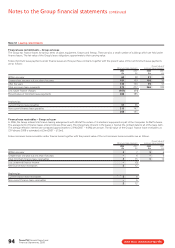

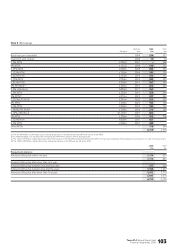

Finance lease receivables – Group as lessor

In 2006, the Group entered into finance leasing arrangements with UK staff for certain of its electronic equipment as part of the Computers for Staff scheme.

The average term of finance leases entered into was three years. The interest rate inherent in the leases is fixed at the contract date for all of the lease term.

The average effective interest rate contracted approximates to 2.6% (2007 – 4.0%) per annum. The fair value of the Group’s finance lease receivables at

23 February 2008 is estimated at £5m (2007 – £12m).

Future minimum lease receivables under finance leases together with the present value of the net minimum lease receivables are as follows:

Present value of

Minimum lease payments minimum lease payments

2008 2007 2008 2007

£m £m £m £m

Within one year 5756

Greater than one year but less than five years –6–6

Total minimum finance lease receivables 513 512

Less unearned finance income –(1)

Net finance lease receivables 512

Analysed as:

Current finance lease receivables 56

Non-current finance lease receivables –6

512

Tesco PLC Annual Report and

Financial Statements 2008

94

Notes to the Group financial statements continued

www.tesco.com/annualreport08