Tesco 2008 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2008 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tesco PLC Annual Report and

Financial Statements 2008 93

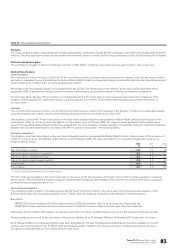

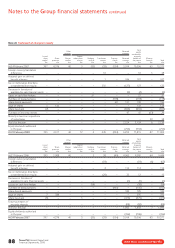

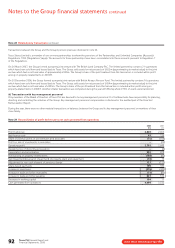

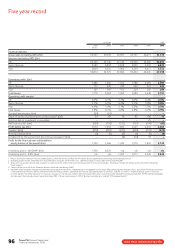

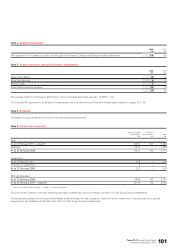

Note 30 Analysis of changes in net debt

Restated Other

At 24 Feb At 24 Feb non-cash At 23 Feb

2007 Adjustment12007 Cash flow movements 2008

£m £m £m £m £m £m

Cash and cash equivalents 1,042 – 1,042 801 (55) 1,788

Short-term investments – – – 360 – 360

Finance lease receivables 12 – 12 (7) – 5

Joint venture loan receivables – 163 163 36 (26) 173

Derivative financial instruments 108 – 108 (16) 221 313

Cash and receivables 1,162 163 1,325 1,174 140 2,639

Bank and other borrowings (1,518) – (1,518) 61 (576) (2,033)

Finance lease payables (36) – (36) 28 (43) (51)

Derivative financial instruments and other liabilities (87) – (87) 365 (721) (443)

Debt due within one year (1,641) – (1,641) 454 (1,340) (2,527)

Bank and other borrowings (3,999) – (3,999) (2,173) 415 (5,757)

Finance lease payables (147) – (147) (108) 40 (215)

Derivative financial instruments and other liabilities (399) – (399) 23 54 (322)

Debt due after one year (4,545) – (4,545) (2,258) 509 (6,294)

(5,024) 163 (4,861) (630) (691) (6,182)

1 The measurement of net debt has been revised to include loans receivable from joint ventures. Going forward net debt will be stated inclusive of the loans receivable from joint ventures.

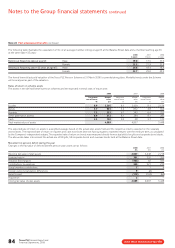

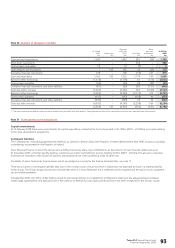

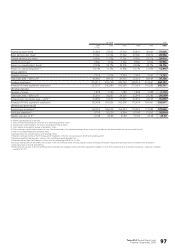

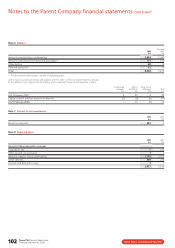

Note 31 Commitments and contingencies

Capital commitments

At 23 February 2008 there were commitments for capital expenditure contracted for, but not provided, of £1,309m (2007 – £2,003m), principally relating

to the store development programme.

Contingent liabilities

The Company has irrevocably guaranteed the liabilities, as defined in Section 5(c) of the Republic of Ireland (Amendment Act) 1986, of various subsidiary

undertakings incorporated in the Republic of Ireland.

Tesco Personal Finance, in which the Group owns a 50% joint venture share, has commitments, as described in its own financial statements as at

31 December 2007, of formal standby facilities, credit lines and other commitments to lend, totalling £5.9bn (2007 – £5.5bn). The amount is intended

to provide an indication of the volume of business transacted and not of the underlying credit or other risks.

For details of assets held under finance leases, which are pledged as security for the finance lease liabilities, see note 11.

There are a number of contingent liabilities that arise in the normal course of business which if realised are not expected to result in a material liability

to the Group. The Group recognises provisions for liabilities when it is more likely than not a settlement will be required and the value of such a payment

can be reliably estimated.

In September 2007, the Office of Fair Trading issued its provisional findings in its Statement of Objections relating to the alleged collusion between

certain large supermarkets and dairy processors. We continue to defend our case vigorously. No provision has been recognised in the Group’s results.