Tesco 2008 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2008 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tesco PLC Annual Report and

Financial Statements 2008 79

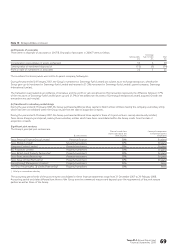

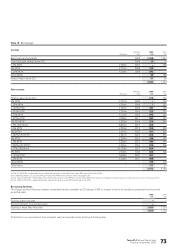

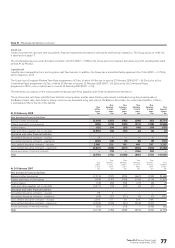

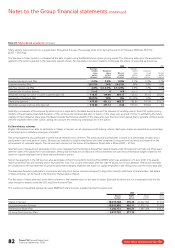

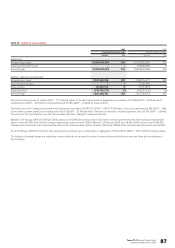

Note 21 Financial risk factors continued

Using the above assumptions, the following table shows the illustrative effect on the Group Income Statement and equity that would result from changes

in UK interest rates, and in the Euro to Sterling exchange rate:

2008 2007

Income Equity Income Equity

gain/(loss) gain/(loss) gain/(loss) gain/(loss)

£m £m £m £m

Assets

1% increase in GBP interest rates (42) – (36) –

5% appreciation of the Euro (5) (32) 1 (35)

5% appreciation of the South Korean Won ––– (19)

5% appreciation of the US Dollar (2) 43 (1) 19

5% appreciation of the Thai Baht – (1) – (17)

10% appreciation of the Czech Koruna – (27) – (48)

15% appreciation of the Polish Zloty 1 (102) – (195)

20% appreciation of the Slovak Koruna 2 (87) – (72)

The impact on equity from changing exchange rates results principally from foreign currency deals used as net investment hedges. The impact on equity

will largely be offset by the revaluation in equity of the hedged assets. For changes in the USD/GBP exchange rate, the impact on equity results principally

from forward purchases of USD as cash flow hedges.

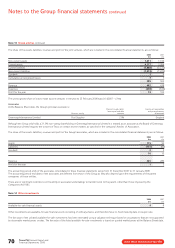

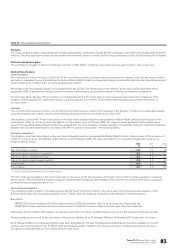

Capital risk

The Group’s objectives when managing capital (defined as net debt plus equity) are to safeguard the Group’s ability to continue as a going concern

in order to provide returns to shareholders and benefits for other stakeholders, while maintaining a strong credit rating and headroom whilst optimising

return to shareholders through an appropriate balance of debt and equity funding. The Group manages its capital structure and makes adjustments to it,

in light of changes to economic conditions and the strategic objectives of the Company.

To maintain or adjust the capital structure, the Group may adjust the dividend payment to shareholders, buy back shares and cancel them or issue new

shares. In April 2006, we outlined our plan to release cash from our property assets, via a sequence of property joint ventures and other transactions,

and return significant value to shareholders, either through enhanced dividends or share buy-backs. The target for the value of share buy-backs was

increased from £1.5bn to £3.0bn over a five-year period from April 2007. We have continued with this policy throughout the current financial year,

purchasing and cancelling £657m ordinary shares, taking the total to £1,042m.

The policy for debt is to ensure a smooth debt maturity profile with the objective of ensuring continuity of funding. This policy continued during the current

year with bonds redeemed of £447m and new bonds issued totalling £2,034m. The Group borrows centrally and locally, using a variety of capital market

issues and borrowing facilities to meet the requirements of each local business.

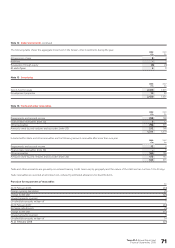

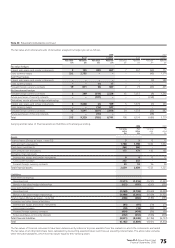

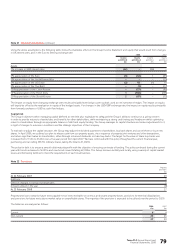

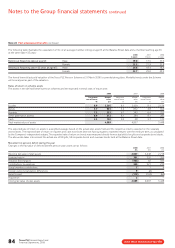

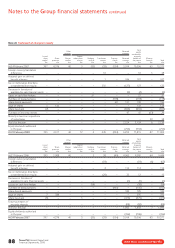

Note 22 Provisions

Property

provisions

£m

At 24 February 2007 29

Additions 3

Effect of changes in foreign exchange rates 3

Amount utilised in the year (8)

At 23 February 2008 27

Property provisions comprise future rents payable net of rents receivable on onerous and vacant property leases, provisions for terminal dilapidations

and provisions for future rents above market value on unprofitable stores. The majority of the provision is expected to be utilised over the period to 2020.

The balances are analysed as follows:

2008 2007

£m £m

Current 44

Non-current 23 25

27 29