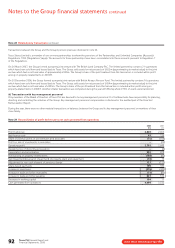

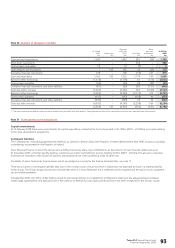

Tesco 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tesco PLC Annual Report and

Financial Statements 2008 91

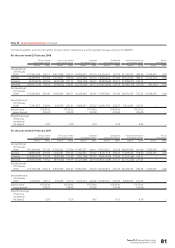

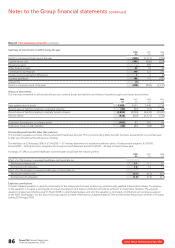

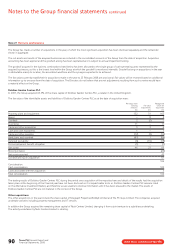

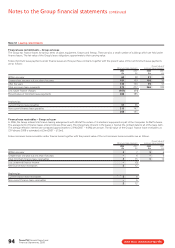

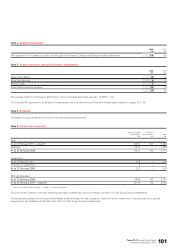

Note 27 Business combinations continued

The book and fair values of the identifiable assets and liabilities of these other acquisitions as at the date of acquisition are disclosed in the table below:

Pre-acquisition Recognised

carrying Fair value values on

amounts adjustments acquisition

£m £m £m

Property, plant and equipment 134

Inventories 2–2

Trade and other receivables 2–2

Cash and cash equivalents 2–2

Trade and other payables (2) – (2)

Net assets 538

Transferred from investments in joint ventures (4)

Net assets acquired 4

Goodwill arising on acquisition (in addition to previously held goodwill of £3m) 9

13

Consideration:

Cash consideration 13

Total consideration 13

The post-acquisition contribution of the other acquisitions to the Group was £12m to revenue and £nil of operating profit.

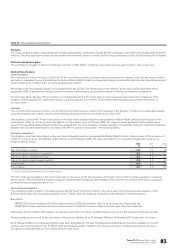

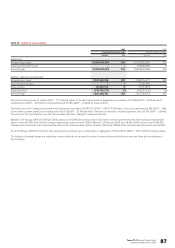

On 24 January 2007 Tesco Stores Malaysia Sdn Bhd acquired 100% of the share capital of Makro Cash and Carry Distribution Sdn Bhd, which operated

a chain of eight stores in Malaysia. The provisional fair value of assets and liabilities at the date of acquisition was included in the financial statements

at 24 February 2007.

During the financial period ended 23 February 2008 and within 12 months of the date of acquisition, we restated the fair value of assets and liabilities

at the date of acquisition principally due to the inclusion of an independent valuation of freehold and leasehold property. Based on exchange rates at the

date of transaction this led to a decrease in goodwill of £3m. This reduction comprised an increase in the fair value of property, plant and equipment of

£12m, decrease in trade and other receivables of £7m and an increase in trade and other payables of £2m.

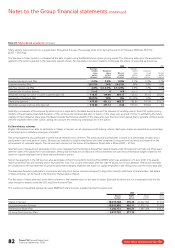

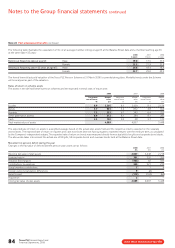

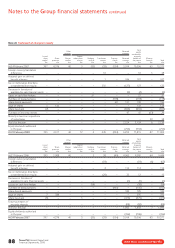

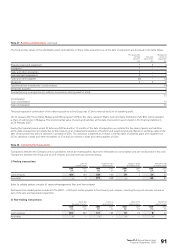

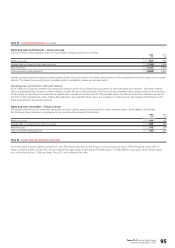

Note 28 Related party transactions

Transactions between the Company and its subsidiaries, which are related parties, have been eliminated on consolidation and are not disclosed in this note.

Transactions between the Group and its joint ventures and associates are disclosed below:

i) Trading transactions

Sales to Purchases from Amounts owed Amounts owed

related parties related parties by related parties to related parties

2008 2007 2008 2007 2008 2007 2008 2007

£m £m £m £m £m £m £m £m

Joint ventures 164 144 238 190 39 534 45

Associates –3771 658 ––82 83

Sales to related parties consists of services/management fees and loan interest.

Purchases from related parties include £157m (2007 – £107m) of rentals payable to the Group’s joint ventures, including those joint ventures formed as

part of the sale and leaseback programme.

ii) Non-trading transactions

Sales and Loans to Loans from Injection of

leaseback of assets related parties related parties equity funding

2008 2007 2008 2007 2008 2007 2008 2007

£m £m £m £m £m £m £m £m

Joint ventures 652 527 173 163 10 10 847

Associates –––––––3