Tesco 2008 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2008 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Tesco PLC Annual Report and

Financial Statements 2008 11

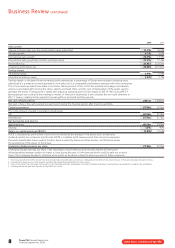

> Our business in Poland had a good year with strong growth in market

share, driven by the successful integration and conversion of the former

Leader Price stores, combined with organic expansion across our range of

1k, 2k and 3k formats. In a difficult consumer and business environment,

sales grew well – with like-for-like growth of 43% in the converted stores.

Returns are expected to move forward in the current year as the business

absorbs the additional capital involved in last year’s acquisition and

delivers the full benefits of the enlarged business and the increasing

profitability of the converted stores.

> An excellent performance from Tesco Ireland produced another year

of strong growth, with good progress in all areas of the business.

The planned operational benefits from our new 740,000 square feet

distribution centre (DC) at Donabate, in north Dublin, which opened in

the first half, are now coming through well. Our pipeline of new space is

strong – through store extensions, new and replacement stores. We now

have six Extra hypermarkets trading in Ireland, which are proving very

popular with customers and 12 Express stores – with more to come

this year. Our new non-food ranges – including Florence & Fred and

Cherokee clothing – are performing particularly well.

> In Slovakia our new clothing and hardlines distribution centres, located

close to Bratislava, which handle general merchandise for the whole

of Central Europe, are now fully operational and delivering significant

benefits. These substantial investments are enabling our Central

European businesses to harmonise and improve our non-food ranges

and deliver lower prices for customers. Our market-leading retail business

there has made very good progress against the background of a strong

economy. Our new store opening programme, which is now focused on

our compact hypermarket and smaller 1k formats, delivered 9% growth

in selling area in the year.

> In Tu rkey, our Kipa business continues to grow rapidly and profitably

and we are making progress towards creating a national chain of

hypermarkets in a market which offers great potential. We are investing

in creating the necessary infrastructure for long-term expansion with our

first major distribution centre at Yasibasi covering 400,000 square feet,

now in operation and with similar infrastructure projects planned over

the next two years as we begin to secure sites in Istanbul, Ankara and

the other cities in central and western Turkey. We aim to grow our space

in Turkey by around 60% this year, from our base of 26 hypermarkets.

Customer response to the Express format has been very encouraging

and we plan to add more than 40 further stores this year, bringing the

total to over 80.

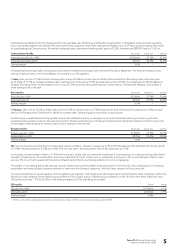

United States We are very encouraged by the start Fresh & Easy has

made. The first stores opened only in November and we now have over

60 trading. Whilst it is still early days, the response of customers to our offer

has surpassed our expectations – with our research regularly confirming

that they like the quality and freshness of our ranges, as well as the prices

and the convenient locations of the stores.

Sales are ahead of budget and sales densities are already higher than the

US supermarket industry average, with our best stores exceeding $20

per square foot per week. We are seeing strong growth in the early stores

as we step up, as planned, our marketing programmes and as we build

awareness of the brand. This is also reflected in the strong sales performance

of recent openings in all of our markets in Southern California, Nevada

and Arizona. Fresh foods and own brand products have sold particularly

well, confirming that the core of our offer has already gained acceptance

with customers.

Progress with real estate has been good and we have secured enough

sites for our immediate needs – although the deteriorating property market,

particularly in Arizona and Nevada, will mean that some of the third-party

developments in which we had planned to open prototype stores later this

year, will now be deferred. Nevertheless, we still expect to open around

150 new stores this year.

Our Riverside distribution centre (DC) and kitchen operation is gearing up

well as volumes rise. As we announced last November, we have taken the

necessary steps to secure the site and begin the process of obtaining the

necessary permits to launch operations of our second DC in Northern

California in due course. We expect a proportion of these costs will be

incurred in the current year.

Last April, with our Preliminary Results, we said that costs of recruitment

and training of staff for the stores, combined with the other pre-launch

costs and initial trading losses, would involve estimated US start-up costs

of around £65m in the financial year. We have delivered on this guidance –

trading losses were £62m. We expect losses to rise this year to around £100m.

US segmental reporting of sales and trading results within International

will begin with our Interim Results in September.

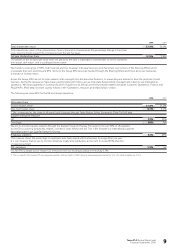

Core UK operations

In the UK, Tesco coped well with unseasonal summer weather, recovering

competitors and a deteriorating non-food market, particularly in the

second half, to deliver solid progress in the year by investing in improving

the shopping trip for customers. UK sales grew by 6.7%, with a like-for-

like increase, including petrol, of 3.9%. Both customer numbers and

spend per visit increased.

In the current year we expect to trade the business harder and give

what help we can to families whose budgets have become increasingly

stretched by higher interest rates, fuel costs and taxes. As always, we are

investing to improve all aspects of the shopping trip. We have already

announced a significant – and budgeted – round of price cuts, involving

an investment of £170m and this is in addition to the strengthened

programme of half-price and other promotions we have been running

since January.

Every Little Helps

> Our Price Check survey, which compares 10,000 prices against our

leading competitors weekly, shows that our price position has improved

again (for more information see www.tesco.com). We have already cut

the price of 7,500 products this year and in the last decade, Tesco has

saved a typical household £5,000 by investing in even lower prices

for customers.

> We are able to monitor and improve our checkout service using our

new thermal imaging technology. A renewed focus on reducing queues

for customers has delivered significant improvements – with a remarkable

22.5 million more customers benefiting from our ‘one-in-front’ promise.

Customers recognise Tesco as offering the best checkout service in

the market.

> The broad appeal of the Tesco brand drives our work on ranges.

We have seen solid growth across our food categories. We launched

a comprehensive update of our Healthy Living range in January –

and customer feedback has been very good. Our Organics range is

still growing well and Finest is now the UK’s biggest brand – with sales

of £1.2 billion. Last week, we did our first big event of the year on

Value, delivering great prices for customers right across the store.

> On-shelf availability, which we measure using our in-store picking of

tesco.com orders, has improved again and more customers are able

to buy everything they want when they shop at Tesco. We have made

particularly strong progress on fresh availability with projects including

better weather forecasting and working with our suppliers to reduce

lead times.

> All 7,000 of our eligible own-brand products now carry our GDA

nutritional signpost labels. We have created a system that is easy to

understand and practical to use and sales data confirms we have

made a genuine impact on customer behaviour.