Tesco 2008 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2008 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tesco PLC Annual Report and

Financial Statements 2008 29

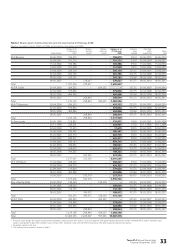

Share options

Options over shares with a value of 200% of salary are granted to the

Executive Directors on an annual basis. Options are granted with an

exercise price equal to the market value at the date of grant and any gain

is therefore dependent on increasing the share price between the date of

grant and exercise. Vesting of the options is conditional on the achievement

of earnings per share performance conditions, with the first 100% subject

to the achievement of EPS growth of at least RPI plus 9% over three years

and the balance vesting for achieving EPS growth of at least RPI plus 15%.

There is no re-testing of performance.

Following the Remuneration Committee’s consideration of the extent

to which the earnings per share performance conditions for the options

granted to the Executive Directors in 2005/6 have been achieved, these

options will vest in full.

Share options are an important part of the incentive framework for

hundreds of senior managers within Tesco. The Committee recognises

that some companies are moving away from share options and

has again considered the appropriateness of retaining this scheme.

The Committee remains highly confident that the share option plans

remain in the best interests of shareholders as they provide a clear,

simple incentive arrangement for a large group of senior management,

including Executive Directors, and they reward increases in absolute

shareholder value.

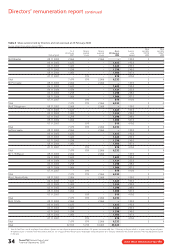

Funding of awards

Executive incentive arrangements are funded by a mix of newly issued

shares and shares purchased in the market. Where shares are newly

issued the company complies with ABI dilution guidelines on their issue.

Share ownership guidelines

Executive Directors are normally expected to build and maintain a

shareholding with a value at least equal to their basic salary. New appointees

will typically be allowed around three years to establish this shareholding.

Full participation in the PSP is conditional upon this. All Executive Directors

currently satisfy this requirement.

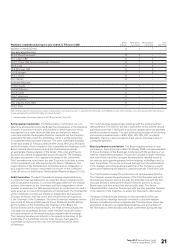

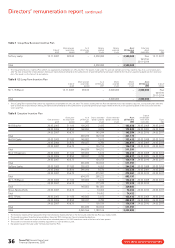

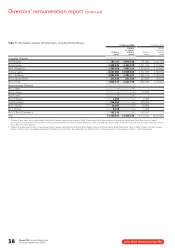

Summary of remuneration elements

All awards made to Executive Directors under the Annual Bonus, PSP,

US LTIP and Group New Business Incentive Plan, and all options granted

under the Discretionary Share Option Plan are subject to the satisfaction

of performance conditions. If performance is lower than the maximum

targets, the short-term bonus and long-term incentives will reduce accordingly.

The Committee has reviewed the performance conditions for each of the

incentive arrangements against the Group’s business strategy, its growing

global leadership, its position as one of the rising companies at the top of

the FTSE 100 and increasing competition from private equity in the sector

and has concluded that they provide a set of comprehensive and robust

measures of management’s effort and success in creating shareholder value.

A summary of the elements of the package and the applicable performance

measures is set out in the table below.

Element of remuneration Performance measure Purpose

Base salary Individual contribution to the business success To attract and retain talented people

Annual cash bonus For all Executives, earnings per share and specified Motivates year-on-year earnings growth and

(Up to 100% of salary) corporate objectives delivery of strategic business priorities

(Additional potential of up to For the US CEO, objectives relating to early-stage progress Incentivises entrepreneurial spirit and early

50% of salary for US CEO) in establishing the US operations stage progress of US business

Annual deferred share element For all Executives, total shareholder return, EPS and Generates focus on medium-term targets and,

(Up to 100% of salary) specified corporate objectives by incentivising share price and dividend growth,

ensures alignment with shareholder interests.

(Additional potential of up to Objectives relating to early-stage progress in establishing Incentivises entrepreneurial spirit and early

50% of salary for Group CEO new business ventures for the Group CEO, and relating stage progress of US business

and US CEO) to the successful start-up of the US operations for the

US CEO

Performance Share Plan Group performance: Group ROCE Assures a focus on long-term business success

(Up to 150% of salary: International performance: International ROCE and shareholder returns

100% for Group performance; and

50% for International performance*) The Committee will also take account of sales growth and

* US CEO not eligible for the 50% underlying profit growth in determining levels of vesting

relating to International performance

US Long-Term Incentive Plan US performance: US EBIT and ROCE Incentivises establishment of a successful

(One-off award to US CEO US business over the long term

of 2 million shares, pays out in

four tranches 2010 to 2014)

Group New Business Incentive Plan New Business Performance: initially just US EBIT/ROCE, Incentivises establishment of a successful new

(One-off award to Group CEO of but no payout unless Group and International ROCE businesses over the long term, but ensures

2.5 million shares, pays out in targets are also achieved continued focus on the Group as a whole

four tranches 2010 to 2014)

Share options EPS relative to retail price index Incentivises earnings growth and Executive

Director shareholding