Tesco 2008 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2008 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tesco PLC Annual Report and

Financial Statements 2008 55

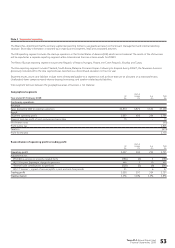

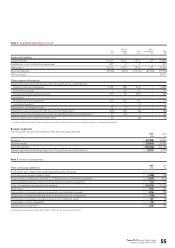

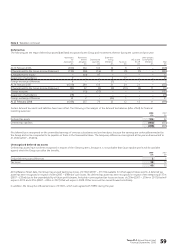

Note 2 Segmental reporting continued

Rest of Other/

UK Europe Asia unallocated Total

£m £m £m £m £m

Assets and liabilities

Segment assets 16,323 4,552 3,397 221 24,493

Investments in joint ventures and associates 307 2 5 – 314

Total assets 16,630 4,554 3,402 221 24,807

Segment liabilities (5,602) (903) (1,031) (6,700) (14,236)

Total net assets 10,571

Other segment information

Capital expenditure (including acquisitions through business combinations):

Property, plant and equipment 1,765 786 516 – 3,067

Investment property – 36 22 – 58

Goodwill and other intangible assets 197 52 420 – 669*

Depreciation:

Property, plant and equipment 520 155 99 – 774

Investment property – 7 4 – 11

Amortisation of intangible assets 79 8 6 – 93

Impairment losses recognised in the Group Income Statement (44) (35) (3) – (82)

Reversal of prior period impairment losses through the Group Income Statement 17 46 – – 63

Profit/(loss) arising on property-related items 98 – (6) – 92

* Includes £166m of goodwill transferred in from joint ventures, following the acquisition of additional shares in dunnhumby and Hymall.

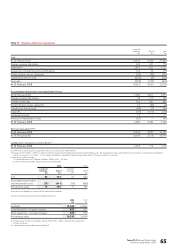

Business segments

The Group has one business segment, retail and associated activities.

2008 2007

£m £m

Revenue 47,298 42,641

Segment assets 29,859 24,493

Segment liabilities (18,262) (14,236)

Capital expenditure (including acquisitions through business combinations) 4,215 3,794

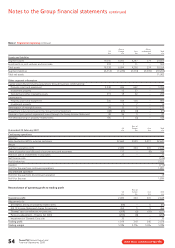

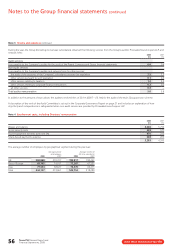

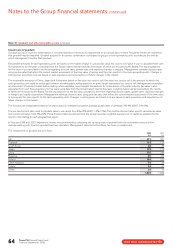

Note 3 Income and expenses

2008 2007

From continuing operations £m £m

Profit before tax is stated after charging/(crediting) the following:

Profit arising on property-related items (188) (92)

Rental income, of which £211m (2007 – £166m) relates to investment properties (267) (210)

Direct operating expenses arising on rental earning investment properties 54 47

Costs of inventories recognised as an expense 35,279 31,104

Stock losses 700 581

Depreciation of property, plant and equipment and investment property 876 785

Net (reversal of impairment)/impairment of property, plant and equipment (10) 19

Amortisation of internally-generated development intangible assets 87 69

Amortisation of other intangibles 29 24

Operating lease expenses(a) 520 394

(a) Operating lease expenses include £88m (2007 – £89m) for hire of plant and machinery.