Tesco 2008 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2008 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tesco PLC Annual Report and

Financial Statements 2008 25

This is the report of the Remuneration Committee on behalf of the Board.

Remuneration Committee

The Remuneration Committee (the Committee) is governed by formal

Terms of Reference. They are reviewed annually and are available

from the Company Secretary upon request or can be viewed at

www.tesco.com/annualreport08/boardprocess.

Composition of the Committee

The Committee consists entirely of independent Non-executive Directors.

The members of the Committee are Mr C L Allen (Chairman of the

Committee), Mr R F Chase, Mrs K Cook, Mr E M Davies and Dr H Einsmann.

No member of the Remuneration Committee has any personal financial

interest in the matters being decided, other than as a shareholder, nor any

day-to-day involvement in running the business of Tesco. Mr J M Lloyd,

the Company Secretary, is Secretary to the Committee. Mr D E Reid,

Non-executive Chairman, and Sir Terry Leahy, Chief Executive of the Group,

both attend meetings at the invitation of the Committee. They are not

present when their own remuneration is being discussed. The Committee

is supported by the Group Personnel and Finance functions and has

continued to use the services of Deloitte & Touche LLP whom it appointed

as an external, independent advisor. Deloitte & Touche LLP also provided

advisory services in respect of corporate tax planning, share schemes,

international taxation, corporate finance and treasury to the Group during

the year. Members’ attendance at Committee meetings is listed in the

Corporate Governance section on page 21 of the Annual Report and

Financial Statements 2008.

The role of the Committee

The Committee’s purpose is to:

> determine and recommend to the Board the remuneration policy for

the Chairman and Executive Directors;

> ensure the level and structure of remuneration is designed to attract,

retain, and motivate the Executive Directors needed to run the Company;

and

> monitor the level and structure of remuneration for senior management.

The Committee also ensures that the remuneration relationship between

the Executive Directors and senior executives of the Company below this

level is appropriate. In particular, the Committee is advised of any exceptional

remuneration arrangements for senior executives.

Activities of the Committee

The Committee normally meets at least four times a year and circulates

minutes of its meetings to the Board. During the financial year ending

23 February 2008 the Committee met seven times. The rolling schedule

for the Committee includes: a review of overall remuneration arrangements;

an overview of best practice; Executive salary and total remuneration

benchmarking; the review of Chairman’s remuneration; consideration of the

relationship of reward between Executive Directors and senior managers;

determining the level of awards and grants to be made under the Group

incentive plans; agreeing targets for the forthcoming year; considering

feedback from shareholders; and an annual review of its own effectiveness.

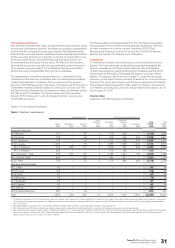

Executive Directors’ remuneration policy

Tesco has a long-standing policy of rewarding talent and experience.

We also seek to provide incentives for delivering high growth and high

returns for shareholders. The Committee believes that a significant

proportion of total remuneration should be performance-related and

delivered largely in shares to closely align the interests of shareholders

and Executive Directors. In determining the balance between the fixed

and variable elements of the Executive Directors’ remuneration packages,

the Committee has regard to both policy and market practice.

The remuneration strategy for Executive Directors and other key executives

is tailored to emphasise the delivery of strong year-on-year earnings

growth as well as sustained performance in the longer term. Long-term

performance is rewarded through delivery of shares and short-term

performance through a combination of cash and an element of compulsory

deferred shares. This ensures continued emphasis on strong annual

performance combined with long-term executive share ownership,

providing a strong link between the incentives received and shareholder

value delivered. A diagram illustrating the balance between fixed and

variable reward is shown later in this report on page 26.

Tesco operates in a highly competitive and rapidly changing retail

environment. Business success depends on the talents of the key team,

but outstanding business performance comes from teamwork. Tesco has

a stable and successful management team and building and retaining that

team at senior levels within Tesco is important to our continued success.

We believe our incentives should support the continued progress within

the existing business, the strengthening of our returns from the International

business and the creation of significant new businesses, such as the

US venture.

In the past year the Committee reviewed the Group’s existing remuneration

arrangements in light of these requirements and concluded that a

rebalancing of incentives was required, which resulted in the introduction

of several new elements to the Executive remuneration structure:

> the establishment of a Group New Business Incentive Plan which focuses

on long-term business development (four to seven years into the future);

> the introduction of an additional element into our current three-year

Performance Share Plan which targets the performance of our existing

international business; and

> the adoption of a new US Long-Term Incentive Plan for our US Executive

team to ensure that we can attract great talent to build our US business.

The Group New Business Incentive Plan and the US Long-Term Incentive

Plan were both approved by shareholders at last year’s AGM.

Participation in the various elements is governed by the Remuneration

Committee and individual Executives are awarded incentives under the

elements which are most relevant to their sphere of responsibility.

The Group CEO, Sir Terry Leahy, has responsibility for delivering the

continued success of our core business, developing our international

business and also laying the foundations of major new businesses.

His incentives therefore reflect these three responsibilities: the core

reward; an award under the Performance Share Plan focused on improving

international ROCE; a one-off award under the new Group New Business

Incentive Plan; and participation in a New Business short-term bonus for

the next three years of 50% of salary based on achievement of financial

and strategic milestones for new business development. The one-off award

under the Group New Business Incentive Plan will only pay out in full if both

challenging new business performance targets over the period 2010/11

to 2013/14 are met and stretching Group and international ROCE targets

are also met over the periods 2007/8 to 2011/12.

The US venture is currently the most developed new business initiative with

significant opportunity to generate long-term shareholder value. Sir Terry

Leahy is the architect of the concept and format of the new US business,

and his continued leadership and drive are critical to the success of this

start-up business. Payment of his award under the Group New Business

Incentive Plan will therefore initially be focused on the new US business;

however, the Remuneration Committee will have flexibility to consider and

include other new business development opportunities within the proposed

structure, if appropriate.

Directors’ remuneration report

year ended 23 February 2008