Tesco 2008 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2008 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Tesco PLC Annual Report and

Financial Statements 2008

10 www.tesco.com/annualreport08

Operations, resources and relationships

International operations

The performance of our international businesses has been outstanding –

with excellent progress in sales, profits and returns. The growing strength of

our operations and market positions internationally gives us confidence that

we can deliver further strong progress in the years ahead. Our International

diversification has come of age and, in delivering half of the year’s Group

trading profit growth, it has demonstrated its increased strength and

maturity – with much more to come.

We are seeing the benefits of last year’s acquisitions, and organic growth

in selling space also continues to be rapid as we build out our networks.

We opened a total of 6.2m square feet in Europe and Asia during the year,

an increase of 15%, plus a further 0.5m square feet in the US. Over 60%

of Group sales area is now in International.

At the end of February, our operations in Asia and Europe were trading from

1,561 stores, including 493 hypermarkets, with a total of 45.9m square feet

of selling space. This year, we plan to open 505 new stores with a total of

8.4m square feet of sales area in these markets. A further 1.5m square feet

is planned to open in the US.

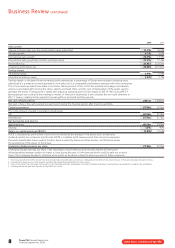

Returns – CROI

All our established markets are now profitable and with growing local

scale, increasing store maturity and the benefits of new investment in

supply chain infrastructure, returns from our international operations are

continuing to rise. On a constant currency basis and excluding China, cash

return on investment (CROI*) for International was the same as last year

at 11.5%. This reflects the rise in invested capital linked to our acquisitions

in Poland and the Czech Republic in 2006 and higher capital expenditure.

Like-for-like CROI shows a strong improvement, rising to 13.1% (last year

12.7%), with our lead markets maintaining significantly higher levels

overall. Returns in Turkey and Malaysia have shown pleasing improvement.

In Central Europe, Hungary and Slovakia delivered increases in returns,

while the performance in Poland and the Czech Republic was held back

temporarily by the additional capital linked to our acquisitions in 2006.

Asia We have delivered a very strong performance in Asia, despite retail

markets in our two largest countries – South Korea and Thailand – remaining

subdued. We are now market leader in Malaysia, just seven years after

we entered the country and we are accelerating growth and investment

in China now that we have full control of our business there.

> In China, with majority ownership and full management control of

the business, we have begun to accelerate store and infrastructure

development as part of our long-term strategy to become a leader in

the market. We plan to construct large multi-level freehold shopping

centres, built around Tesco hypermarkets, in the major cities of the

three main economic regions – around Shanghai, Beijing and

Shenzhen/Guangzhou. These regions will each have modern distribution

and supply chain facilities. We now have 56 hypermarkets, mostly around

Shanghai and our first stores in the other regions are trading well. The

first four of our new large developments will be constructed in the current

year. We saw strong sales, including good like-for-like growth in the year

and China made a modest profit.

> The retailing environment in Japan remains difficult. Our small but

profitable business there has continued to focus on refining and

developing the trial Express-type stores, which we began to open last

year – with seven now trading – into an expandable format. We have

strengthened the management team in Japan, invested in infrastructure

and plan a modest new store development programme this year.

* Cash return on investment (CROI) is measured as earnings before interest, tax, depreciation

and amortisation, expressed as a percentage of net invested capital.

> Homeplus in South Korea delivered another excellent performance in

the year; overcoming the challenges of stronger competitors and subdued

consumer spending and achieving solid sales and strong profit growth.

Over 1 million square feet of space was opened during the year and we

have a strong programme of 76 new stores and 1.4m square feet this

year. We will almost double the size of our Express business in 2008/9

to around 130 stores. Our grocery dotcom operation in South Korea is

now well-established and growing rapidly – with sales up by more than

125% in the year.

>Tesco Malaysia has made rapid progress, successfully integrating and

converting the Makro stores and at the same time sustaining very strong

like-for-like growth and moving into profitability for the first time. Six

major refits to the Makro stores to introduce the new Extra format, which

was developed specifically for these sites, are complete and the stores

are trading very well. We have recently become market leader, and with

two more converted stores to be relaunched soon, plus a strong pipeline

of eight planned new hypermarkets, we hope to extend our lead this year.

> Tesco Lotus in Thailand has performed very well. Although consumer

confidence levels remain subdued, our investment in improving our offer

for customers through the political and economic instability of the last

18 months has served us well. Our business has achieved good sales

and profit growth and strengthened its already robust market position.

The successful development and rollout of our formats has picked up

pace again with 106 stores opening with 1.4m square feet of selling

area. This included the opening of ten hypermarkets in the final quarter

of the year.

Europe Our European growth has been stronger than for many years,

helped in part by favourable exchange rate movements. In Central

Europe we are emerging from a long period of economic instability

and intense competition as one of the clear winners across the region –

and the prospects for improving returns as we continue to build our market

positions, and benefit from increased scale, regional economies and

improved infrastructure, have never been better. The work we have done on

pan-European sourcing of Tesco own brand and general merchandise has

further strengthened our competitive position in the region. Our business in

Ireland has also made excellent progress and we are increasingly confident

about the scale of opportunity for Tesco in Turkey as we build on the

excellent Kipa brand, which has already proven itself capable of trading

well across much of the country.

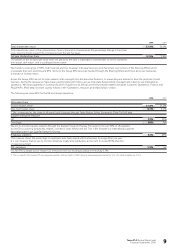

> In the Czech Republic, the benefits of our improved market position –

we are now among the leaders – and stability following the very

successful acquisition and integration of the Carrefour stores last year are

starting to come through well. The performance of the acquired stores

has been excellent – with second year like-for-like sales growth of 11%.

Our first Express stores have also been well-received by customers in

central Prague and we are continuing a programme of refits – and in

some cases major redevelopments – of our department stores.

> The economic background in Hungary is showing early signs of

improvement although the consumer environment remains challenging.

However, our strategy of investing hard to build on our already strong

market position by lowering prices and expanding our store network is

yielding good results. We have seen improving performance from our

stores, including a resumption of like-for-like sales growth last summer,

renewed profit growth and a significant improvement in returns.

Our new store opening programme delivered a 12% increase in our

space – through four large hypermarkets, five of our 3k compact format,

12 1k stores and one Express.

Business Review continued