Tesco 2008 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2008 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Tesco PLC Annual Report and

Financial Statements 2008 7

Current trading

We have seen a strong start to the new financial year across the Group.

In the UK, our planned investments in strengthening further our offer for

customers, involving our latest round of price cuts and the introduction

of stronger promotions – and at the same time continuing to improve

availability and service standards – have gone well. UK like-for-like sales

growth, excluding petrol, was over 4% in the first five weeks of the new

year. This figure is adjusted for the different timing of Easter this year and

is a little ahead of our planned performance range (of between 3% and

4%) for the year as a whole. Within this, inflation was under 1.5%.

International sales progress has also been pleasing. Sales growth was

strong – 19% at actual rates in the first five weeks. Overall, growth

moderated only slightly compared with last year despite passing the

anniversary of the acquisition of both Leader Price in Poland and the

majority holding in our business in China. Total Group sales increased

by 13% in the same period.

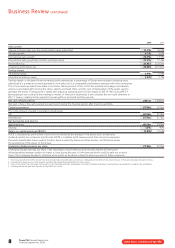

Releasing value from property

Our £5bn-plus programme of releasing value from property through a

sequence of joint ventures and other transactions and return significant

cash to shareholders over five years, both through enhanced dividends

and share buy-backs, is on track.

The two transactions completed in 2007 delivered aggregate proceeds

of £1.2bn. The first of these deals, with the British Airways Pension Fund,

was completed at the end of the 2006/7 financial year. A second, larger

joint venture transaction was completed with The British Land Company

PLC in March 2007 and our reported first half property profits largely

reflected the significant book profit on this transaction. We completed a

third such deal in February 2008 – with Prudential plc – on a 4.8% yield,

realising proceeds of £207m. The premium to book value on this

transaction was 66%.

Whilst yields have increased modestly in recent months, appetite for

Tesco’s property and covenant remains strong, and if market conditions

remain conducive, we expect to be able to complete further transactions

on attractive terms in the months ahead. We are currently in discussion

with potential counterparties. Proceeds will continue to be used to fund

expansion and our share buy-back programme – which has already

re-purchased Tesco shares worth over £1.1bn.

The net bookvalue of our fixed assets is £19.8bn, most of it in our freehold

store portfolio – even after recent property divestments linked to our £5bn

programme. We estimate the current market value of these assets to be

£31bn, representing a 57% premium to bookvalue.

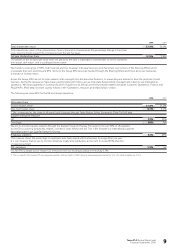

Key performance indicators (KPIs)

We operate a balanced scorecard approach to managing the business

that is known internally within the Group as our ‘Steering Wheel’. This

unites the Group’s resources and in particular focuses the efforts of our

staff around our customers, people, operations, finance and the community.

Its prime focus is as a management tool for the company so that there is

appropriate balance in the trade-offs that need to be made all the time

between the main levers of management – such as operations measures,

financial measures or delivery of customer metrics.

It therefore enables the business to be operated and monitored on a

balanced basis with due regard to the needs of all stakeholders. For the

owners of the business, it is simply based around the philosophy that if

we look after customers well and operate efficiently and effectively then

shareholders’ interests will always be best served by the inevitable outputs

of those – growth in sales, profits and returns.