Suzuki 2011 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2011 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION 7

Overseas Markets

1. Market Overview

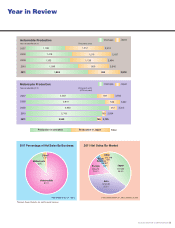

Automobile sales volume in Europe in fiscal 2010

was down by 8% year-on-year at 13,709,000 units

owing partly to the end of purchase subsidies that

had been offered by national governments. By con-

trast, there was significant market growth in India,

where sales grew by 29% year-on-year to 2,520,000

units. Other markets also saw sales growth: Sales

in China were up 18% year-on-year at 18,435,000

units. Sales in North America were up 12% year-on-

year at 12,104,000 units. And sales in the five key

ASEAN countries (Indonesia, Thailand, Vietnam, the

Philippines, and Malaysia) were up 30% year-on-

year at 2,594,000 units.

2. Suzuki Sales

Suzuki’s overseas automobile sales volume in fis-

cal 2010 was up 19% year-on-year at 2,053,000

units. Suzuki saw significant sales growth in its key

markets, India and China. Suzuki’s sales in India

were up 30% year-on-year at 1,133,000 units thanks

partly to new models. They exceeded one million

units in a single fiscal year for the first time. Suzuki’s

sales in China were up 11% year-on-year at 290,000

units owing to growth in the market. Suzuki’s sales

also grew significantly in other markets: They were

up 33% year-on-year at 83,000 units in Pakistan and

up 51% year-on-year at 96,000 units in the five key

ASEAN countries (Indonesia, Thailand, Vietnam,

the Philippines, and Malaysia). By contrast, Suzuki

saw its sales in Europe fall by 14% year-on-year to

243,000 units and saw its sales in the United States

fall by 14% year-on-year to 25,000 units.

3. Suzuki Topics in Fiscal 2010

• CumulativeworldwidesalesoftheSwift(Suzuki’s

first world strategic model, which was launched in

2005) reached two million units in February 2011.

Cumulative sales of the Swift outside Japan stood

at about 1,720,000 units.

• Suzukilaunchedthesecondgenerationofthe

Swift (world strategic model).

• Suzuki’sflagshipsedan,theKizashi,won17

awards in eight countries owing mainly to its per-

formance and handling.

• MarutiSuzukiIndiaachievedcumulativeproduc-

tion volume of 10 million units in March 2011. The

company reached this milestone 27 years and

three months after starting to produce the Maruti

800 in 1983. In anticipation of further growth in

the Indian market, Maruti Suzuki India plans to

increase its annual production capacity from the

current to 1.2 million units to as much as 1.7 mil-

lion units by 2013.

Iwata Plant

Multi-purpose vehicle and commercial vehicle assembling

Kosai Plant

Passenger car assembling

Year in Review

Sagara Plant

Passenger car and automobile engines assembling,

foundry of engine components, machining