Suzuki 2011 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2011 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

22 SUZUKI MOTOR CORPORATION

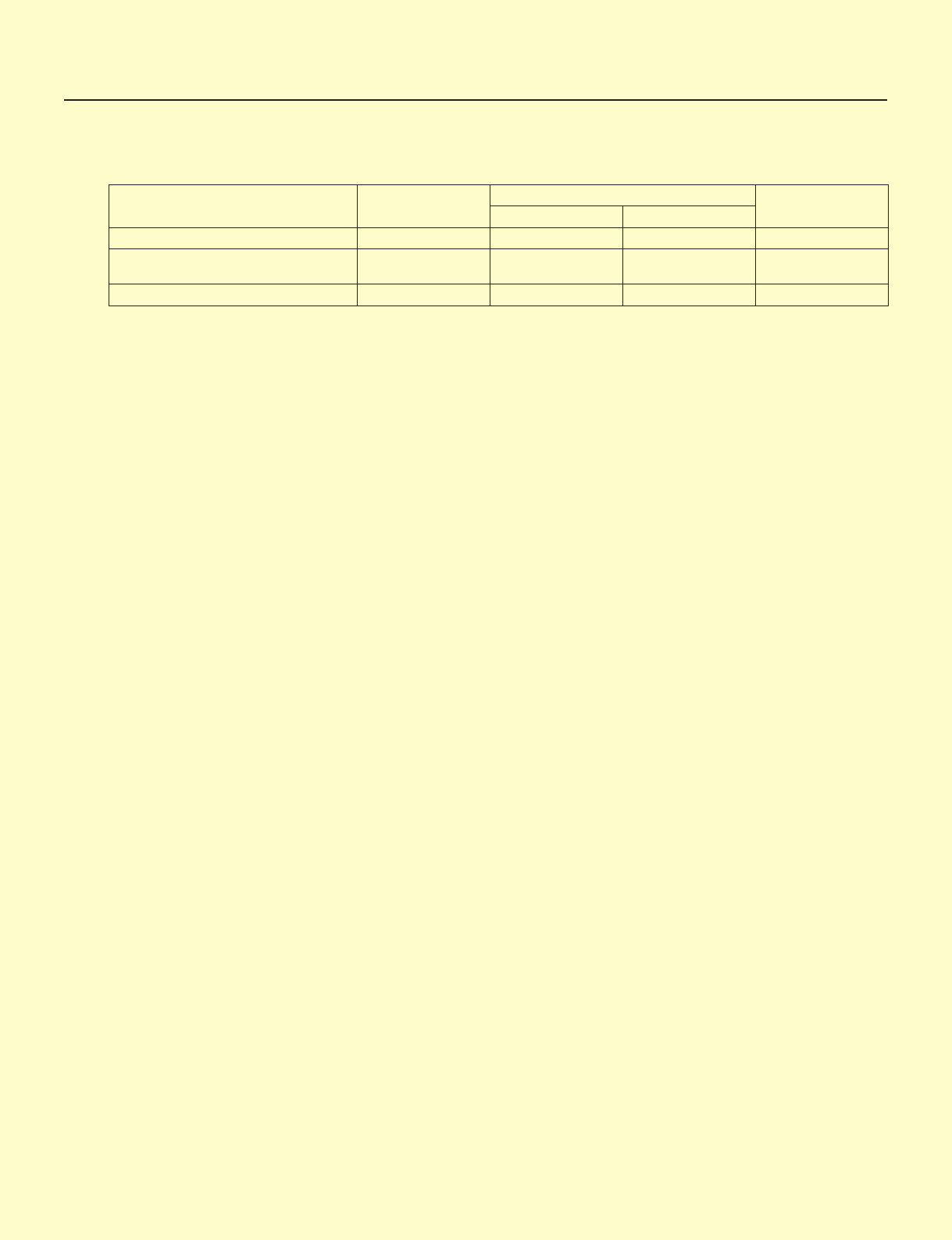

(4) Remuneration for Directors and Corporate Auditors for this fiscal year

Remuneration paid to Directors and Corporate Auditors is as follows:

(Amount of remuneration: million yen, Number of payees: person)

Classification Total amount of

remuneration

Amount of remuneration by remuneration type Number of payees

Basic pay Bonus

Directors 512 339 173 12

Corporate Auditors

(excluding Outside Corporate Auditors) 45 31 14 2

Outside Corporate Auditors 15 12 3 3

Notes: 1. The amount of remuneration limit for directors (¥80 million per month) was resolved at the 135th ordinary general meeting of share-

holders held on June 28, 2001.

2. The amount of remuneration limit for corporate auditors (¥8 million per month) was resolved at the 123rd ordinary general meeting

of shareholders held on June 29, 1989.

3. The above-mentioned bonuses are recorded as provision for directors’ bonuses at the end of this fiscal year and treated as ex-

penses of this fiscal year.

4. ¥1 million was paid to a retired Director and ¥1 million was paid to a retired Corporate Auditor, as pensions for directors and corpo-

rate auditors under the Rules of Retirement Benefit Allowance for Directors and Corporate Auditors.

5. The following information is disclosed in 145th annual securities report.

Total amount of consolidated remuneration paid to persons who received consolidated remuneration of ¥100 million or more each.

(5) Remuneration for Independent Auditor for this fiscal year

(a) The remuneration amount to be paid by the Company to Independent Auditors is ¥72 million.

(b) The remuneration amount to be paid by the Group to Independent Auditors is ¥74 million.

(c) Of the amount shown in (a), the remuneration amount to be paid for audit certification is ¥72 million.

Note: Since the audit agreement between the Company and Independent Auditors does not distinguish the remuneration for auditing based

on the Companies Act of Japan from that for auditing based on the Financial Instruments and Exchange Act of Japan, the Company

can not specify respective amounts substantially and has described the total amount for those audits.

(Reference)

Internal Control Report System under the Financial Instruments and Exchange Act of Japan

Effective from the fiscal year ended March 31, 2009, Internal Control Report System has been applied under the Financial Instru-

ments and Exchange Act of Japan. The Company has established a project team to enhance the system for assessment of the ef-

fectiveness of internal controls over the financial reporting.

Our management executive assessed the effectiveness of internal control over financial reporting as of March 31, 2011 in ac-

cordance with “On the Setting of the Standards and Practice Standards for Management Assessment and Audit concerning Internal

Control Over Financial Reporting (Council Opinions) ” published by the Business Accounting Council of Financial Services Agency,

the Japanese government. Based on that assessment, our management executive concluded that our Group’s internal control over

financial reporting was effective as of March 31, 2011.

Seimei Audit Corporation, the Company’s Independent Auditor, has audited the Internal Control Report made by our management

executive, and expressed an unqualified opinion regarding effectiveness of the Group’s internal control over financial reporting as of

March 31, 2011.

Management policy