Suzuki 2011 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2011 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

SUZUKI MOTOR CORPORATION 47

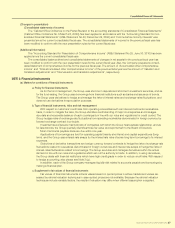

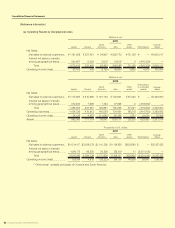

(d) Items related to the calculation standard for the retirement benefit obligation

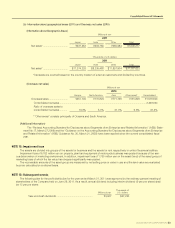

NOTE 7: Accrued retirement and severance benefit

(a) Outline of an adopted retirement benefit system

As for the Company, cash balance corporate pension plan and termination allowance plan are established. And as for

some of consolidated subsidiaries, defined benefit corporate pension plan and termination allowance plan are established.

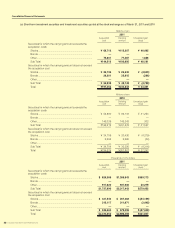

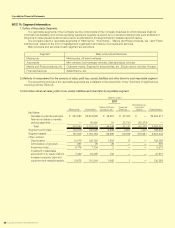

(b) Items related to a retirement benefit obligation

Remarks: 1)

The premium retirement allowance paid on a temporary basis is not included.

2) Some of subsidiaries adopt simplified methods for the calculation of retirement benefits.

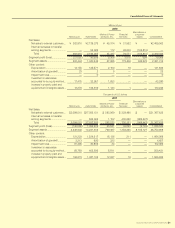

(c) Items related to retirement benefit cost

Remarks: The retirement benefit cost of subsidiaries where simplified methods are adopted is accounted for

“a. Service cost”.

Consolidated Financial Statements

Millions of yen

Thousands of

U.S. dollars

2011 2010 2011

a. Retirement benefit obligation ¥(104,625)¥(103,031)$(1,258,271)

b. Pension assets 70,228 65,834 844,595

c. Unrecognized retirement benefit obligation (a+b) ¥ (34,397)¥ (37,197)$ (413,676)

d. Unrecognized difference by an actuarial calculation 2,701 4,005 32,494

e. Unrecognized prior service cost (decrease of liabilities) (5,427)(6,145)(65,269)

f. Provision for retirement benefits (c+d+e) ¥ (37,122)¥ (39,337)$ (446,451)

Millions of yen

Thousands of

U.S. dollars

2011 2010 2011

a. Service cost ¥6,278 ¥6,961 $75,505

b. Interest cost 1,613 1,592 19,402

c. Assumed return on investment (487)(259)(5,866)

d. Amortized amount of actuarial difference 1,167 881 14,040

e. Amortized amount of prior service cost (722)(718)(8,684)

f. Retirement benefit cost (a+b+c+d+e) ¥7,849 ¥8,457 $94,397

a. Term allocation of the estimated

amount of retirement benefits : Period fixed amount basis

b. Discount rate : 2011 Mainly 2.00%

2010 Mainly 2.00%

c. Reassessment rate : 2011 1.50%

2010 1.50%

d. Assumed return of investment ratio : 2011 0.61% – 1.90%

2010 0.58% – 1.90%

e. Number of years for amortization : Mainly 15 years

of prior service cost To be amortized by straight line method with the employees’

average remaining service years at the time when the

difference was caused.

f. Number of years for amortization : Mainly 15 years

of the difference caused by To be amortized from the next fiscal year by straight line

an actuarial calculation method with the employees’ average remaining service years

at the time when the difference was caused.