Suzuki 2011 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2011 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

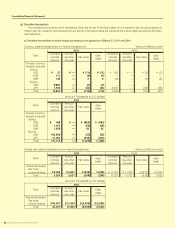

SUZUKI MOTOR CORPORATION 33

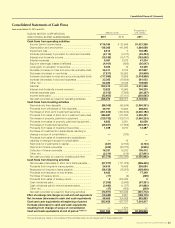

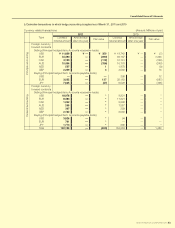

Consolidated Statements of Cash Flows

Years ended March 31, 2011 and 2010

SUZUKI MOTOR CORPORATION

AND CONSOLIDATED SUBSIDIARIES

Millions of yen

Thousands of

U.S. dollars

2011 2010 2011

Cash flows from operating activities

Income before income taxes ............................................. ¥118,186 ¥ 92,499 $1,421,368

Depreciation and amortization .......................................... 138,368 141,846 1,664,088

Impairment loss ................................................................. 8,513 0102,386

Increase (decrease) in provision for retirement benefits .. (2,114)(3,107)(25,424)

Interest and dividends income .......................................... (15,190)(16,177)(182,690)

Interest expenses .............................................................. 5,091 8,276 61,234

Equity in (earnings) losses of affiliates .............................. (4,161)(692)(50,047)

Loss (gain) on valuation of securities ............................... 5,356 19 64,425

Decrease (increase) in notes and accounts receivable-trade

36,411 8,103 437,897

Decrease (increase) in inventories ................................... (7,811)95,993 (93,946)

Increase (decrease) in notes and accounts payable-trade

(117,986)16,859 (1,418,956)

Increase (decrease) in accrued expenses ...................... 23,365 (19,509)281,002

Other, net ............................................................................ 62,280 10,348 749,008

Subtotal 250,310 334,460 3,010,346

Interest and dividends income received .......................... 13,822 16,966 166,239

Interest expenses paid ...................................................... (5,012)(7,888)(60,287)

Income taxes paid ............................................................. (32,650)(17,161)(392,665)

Net cash provided by (used in) operating activities 226,470 326,377 2,723,633

Cash flows from investing activities

Payments into time deposits ............................................. (88,169)(45,844)(1,060,361)

Proceeds from withdrawal of time deposits...................... 49,791 74,606 598,816

Purchases of short-term investment securities ................ (301,849)(464,632)(3,630,182)

Proceeds from sales of short-term investment securities

386,687 313,030 4,650,483

Purchases of property, plant and equipment ................... (129,732)(129,131)(1,560,224)

Proceeds from sales of property, plant and equipment ... 6,823 6,361 82,058

Purchases of investment securities .................................. (25,227)(17,508)(303,391)

Proceeds from sales of investment securities .................. 1,038 9,210 12,487

Purchase of investments in subsidiaries resulting in

change in scope of consolidation ..................................... —(376)—

Proceeds from sales of investments in subsidiaries

resulting in change in scope of consolidation .................. —15 —

Payments for investments in capital ................................. (431)(2,163)(5,194)

Payments of loans receivable ........................................... (326)(40,770)(3,925)

Collection of loans receivable ........................................... 16,331 15,533 196,412

Other, net ............................................................................ (2,314)(616)(27,841)

Net cash provided by (used in) investing activities (87,379)(282,286)(1,050,862)

Cash flows from financing activities

Net increase (decrease) in short-term loans payable ...... (57,077)(171,079)(686,445)

Proceeds from long-term loans payable .......................... 24,616 78,489 296,054

Repayment of long-term loans payable ........................... (38,158)(18,976)(458,906)

Proceeds from issuance of new shares ............................ 6,423 —77,249

Purchase of treasury stock ................................................ (17)(4)(208)

Proceeds from sales of treasury stock .............................. 0222,485 5

Cash dividends paid ......................................................... (7,266)(5,645)(87,391)

Cash dividends paid to minority shareholders ................. (3,480)(1,337)(41,860)

Other, net ............................................................................ (17)(485)(209)

Net cash provided by (used in) financing activities (74,977)103,445 (901,712)

Effect of exchange rate changes on cash and cash equivalents

(15,646)6,551 (188,175)

Net increase (decrease) in cash and cash equivalents 48,466 154,088 582,883

Cash and cash equivalents at beginning of period 583,456 427,797 7,016,917

Increase (decrease) in cash and cash equivalents

resulting from change of scope of consolidation —1,570 —

Cash and cash equivalents at end of period *NOTE 10 ¥631,923 ¥583,456 $7,599,800

The accompanying Notes to Consolidated Financial Statements are an integral part of these statements.

Consolidated Financial Statements