Suzuki 2011 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2011 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48 SUZUKI MOTOR CORPORATION

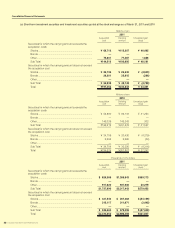

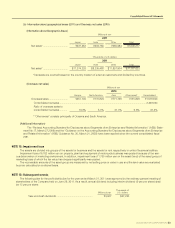

NOTE 8: Income taxes

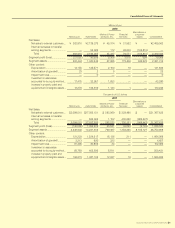

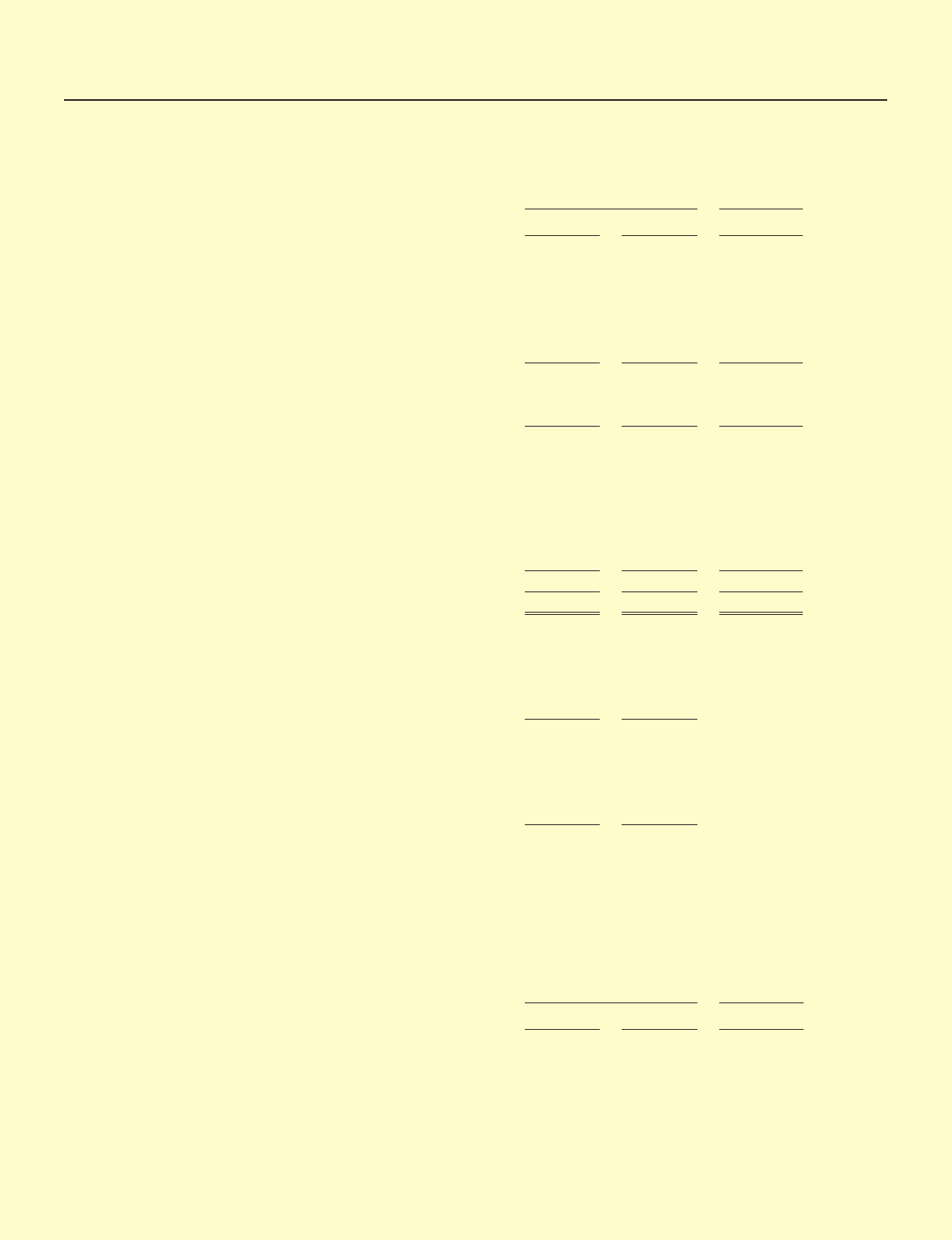

Breakdown of deferred tax assets and deferred tax liabilities by their main occurrence causes were as follows:

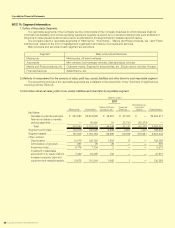

NOTE 9: Research and development costs

Research and development costs included in selling, general and administrative expenses, for the years ended March 31, 2011

and 2010 were as follows:

Millions of yen

Thousands of

U.S. dollars

2011 2010 2011

Deferred tax assets

Excess-depreciation and Impairment loss ....................... ¥ 81,896 ¥ 77,678 $ 984,920

Various reserves ................................................................. 38,850 42,151 467,233

Unrealized gross profits elimination .................................. 17,917 18,434 215,489

Loss on valuation of securities .......................................... 9,413 16,901 113,214

Other ................................................................................... 85,250 83,428 1,025,266

Gross deferred tax assets total ...................................... 233,329 238,595 2,806,124

Valuation allowance ........................................................... (30,357)(23,811)(365,094)

Deferred tax assets total ................................................. ¥202,971 ¥214,784 $2,441,029

Deferred tax liabilities

Valuation difference on available-for-sale securities ........ ¥ (17,171)¥ (10,812)$ (206,518)

Variance from the complete market value method of

consolidated subsidiaries ................................................. (6,104)(6,724)(73,416)

Reserve for advanced depreciation of noncurrent assets

... (4,423)(2,812)(53,200)

Other ................................................................................... (7,955)1,199 (95,679)

Deferred tax liabilities total .............................................. ¥ (35,655)¥ (19,149)$ (428,814)

Net amounts of deferred tax assets .................................. ¥167,315 ¥195,634 $2,012,215

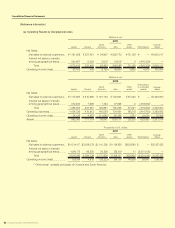

The differences between the statutory tax rate and the effective tax rate were summarized as follows:

2011 2010

Statutory tax rate .................................................................... 39.8% 39.8%

Valuation allowance ........................................................... 9.4% 7.9%

Tax credit ............................................................................ —(0.2%)

Difference in foreign subsidiaries tax rate ........................ (4.1%) (3.7%)

Other ................................................................................... (0.3%) (0.3%)

Effective tax rate .................................................................... 44.8% 43.5%

Millions of yen

Thousands of

U.S. dollars

2011 2010 2011

Research and development costs ........................................ ¥104,079 ¥108,784 $1,251,703

Consolidated Financial Statements