Suzuki 2011 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2011 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42 SUZUKI MOTOR CORPORATION

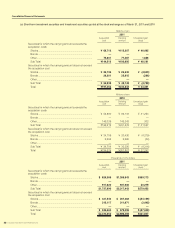

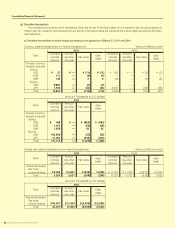

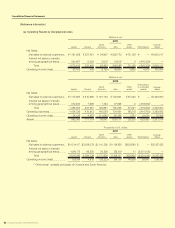

(g) Derivative transactions

The contract/notional amounts of derivatives which are shown in the below table do not represent the Group’s exposure to

market risk. Fair values of derivatives which are shown in the below table are valued at the market rates reported by the finan-

cial institutions.

a. Derivative transactions to which hedge accounting is not applied as of March 31, 2011 and 2010

Currency related transactions (non-market transactions) (Amount: Millions of yen)

Type

2011 2010

Contract/

notional

amount

Amount

due after

one year

Fair value Gain

(loss)

Contract/

notional

amount

Amount

due after

one year

Fair value Gain

(loss)

Foreign currency

forward contracts

Selling

USD ¥ 37 ¥ — ¥ (71)¥ (71)¥ 160 ¥ — ¥ (3)¥ (3)

EUR 112 —(4)(4)————

GBP 135 — 5 5 66 —(6)(6)

Buying

USD 8,882 —(2)(2)————

JPY 1,783 —(44)(44)3,000 —(48)(48)

Total 10,952 —(118)(118)3,226 —(57)(57)

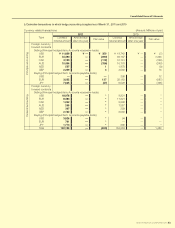

(Amount: Thousands of U.S. dollars)

Type

2011

Contract/

notional

amount

Amount

due after

one year

Fair value Gain

(loss)

Foreign currency

forward contracts

Selling

USD $ 448 $ — $ (865)$ (865)

EUR 1,353 —(56)(56)

GBP 1,629 —62 62

Buying

USD 106,829 —(35)(35)

JPY 21,453 —(534)(534)

Total 131,714 —(1,429)(1,429)

Interest rate related transactions (non-market transactions) (Amount: Millions of yen)

Type

2011 2010

Contract/

notional

amount

Amount

due after

one year

Fair value Gain

(loss)

Contract/

notional

amount

Amount

due after

one year

Fair value Gain

(loss)

Interest rate swaps

Pay fixed

receive floating ¥ 5,255 ¥ 2,627 ¥ (208)¥ (208)¥ 11,757 ¥ 11,757 ¥ (315)¥ (315)

Total 5,255 2,627 (208)(208)11,757 11,757 (315)(315)

(Amount: Thousands of U.S. dollars)

Type

2011

Contract/

notional

amount

Amount

due after

one year

Fair value Gain

(loss)

Interest rate swaps

Pay fixed

receive floating $ 63,207 $ 31,603 $ (2,506)$ (2,506)

Total 63,207 31,603 (2,506)(2,506)

Consolidated Financial Statements